Experian 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.78 Experian Annual Report 2008

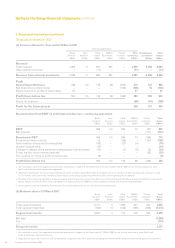

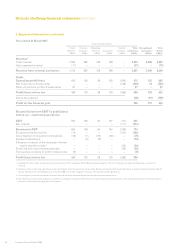

2. Basis of preparation and significant accounting policies (continued)

Past service costs are recognised immediately in the Group income statement, unless the changes to the pension plan are

conditional on the employees remaining in service for a specified period of time (the vesting period). In this case, the past

service costs are amortised on a straight line basis over the vesting period.

The pension cost recognised in the Group income statement comprises the cost of benefits accrued plus interest on the

defined benefit obligation less the expected return on the plan assets over the year.

Defined benefit pension arrangements – unfunded schemes

Unfunded pension obligations are determined in accordance with the principles used In respect of the funded arrangements

but are disclosed in the Group balance sheet within retirement benefit obligations.

Defined contribution pension arrangements

The assets of defined contribution schemes are held separately from those of the Group in independently administered funds. The

pension cost recognised in the Group income statement represents the contributions paid by the Group to these funds in respect

of the year.

Post-retirement healthcare obligations

The Group operates schemes which provide post-retirement healthcare benefits to certain retired employees and their dependent

relatives. The principal scheme relates to former employees in the UK and, under this scheme, the Group has undertaken to

meet the cost of post-retirement healthcare insurance for all eligible former employees who retired prior to 1 April 1994 and their

dependants. Such obligations are disclosed in the Group balance sheet within retirement benefit obligations.

The expected cost of these benefits is calculated using an actuarial methodology similar to that for defined benefit pension

arrangements. Actuarial gains and losses arising from experience adjustments, and changes in actuarial assumptions, are recognised

in the Group statement of recognised income and expense. The obligations are valued annually by independent qualified actuaries.

Minority interests in equity

The minority interests in equity in the Group balance sheet represent the share of net assets of subsidiary undertakings held

outside the Group. The movement in the year comprises the profit attributable to such interests together with any dividends

paid, movements in respect of corporate transactions and related exchange differences.

Where put/call option agreements are in place in respect of shares held by the minority shareholders, the put element of the

liability is measured in accordance with the requirements of IAS 39 ‘Financial Instruments: Recognition and Measurement’ and

is stated at the net present value of the expected future payments. In accordance with the requirements of IAS 32 ‘Financial

Instruments: Disclosure and Presentation’ this liability is shown as a non-current financial liability in the Group balance sheet. The

change in the net present value of such options in the year is recognised in the Group income statement within finance expense.

Critical accounting estimates and assumptions

In preparing the Group financial statements, management is required to make estimates and assumptions that affect the

reported amount of revenues, expenses, assets and liabilities and the disclosure of contingent liabilities. The resulting

accounting estimates, which are based on management’s best judgment at the date of the Group financial statements, will,

by definition, seldom equal the related actual results. The estimates and assumptions that have a significant risk of causing a

material adjustment to the carrying amounts of assets and liabilities within the next financial year are discussed below.

Ta x e s

The Group is subject to taxes in numerous jurisdictions. Significant judgment is required in determining the worldwide provision

for income taxes as there are transactions in the ordinary course of business and calculations for which the ultimate tax

determination is uncertain. The Group recognises liabilities based on estimates of whether additional taxes will be due. Where the

final tax outcome of these matters is different from the amounts that were initially recognised, such differences will impact on the

results for the year and the respective income tax and deferred tax provisions in the year in which such determination is made.

Pension benefits

The present value of the defined benefit obligations depends on factors that are determined on an actuarial basis using a

number of assumptions. The assumptions used in determining the defined benefit obligations and net pension costs include

the expected long-term rate of return on the plan assets and the discount rate. Any changes in these assumptions may

impact on the amounts disclosed in the Group balance sheet and the Group income statement.

Notes to the Group financial statements continued