Experian 2008 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136 Experian Annual Report 2008

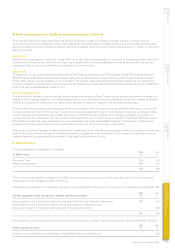

C. Operating loss (continued)

2008 2007

(iv) Net operating lease rental expense £m £m

Costs incurred relating to a property lease 0.3 –

D. Net interest (expense)/income

2008 2007

£m £m

Interest income:

External interest income 0.2 0.3

Interest on amounts owed by subsidiary undertakings – 8.0

Unwinding of discount on amount owed by subsidiary undertaking – 0.7

0.2 9.0

Interest expense:

Interest on amounts owed to subsidiary undertakings – (0.3)

Discount on amount owed by subsidiary undertaking (0.7) –

(0.7) (0.3)

Net interest (expense)/income (0.5) 8.7

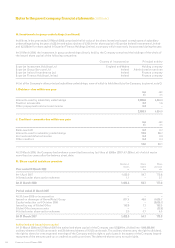

E. Tax on loss on ordinary activities

(i) Tax charge for the year

There was no tax charge for the year (2007: £nil). The applicable rate of corporation tax in Ireland is 25% for investment

income (12.5% for trading income). The reconciliation of the tax charge for the year is as follows:

2008 2007

£m £m

Loss on ordinary activities before taxation (15.2) (4.2)

Loss on ordinary activities before tax multiplied by the applicable rate of

corporation tax in Ireland of 25% (12.5% for trading income) (3.8) (1.1)

Effects of:

Income not taxable – (0.1)

Expenses not deductible 0.4 1.2

Tax losses not utilised 3.4 –

Current tax charge for the year – –

(ii) Factors that may affect future tax charges

In the foreseeable future, the Company’s tax charge will continue to be influenced by the nature of its income and expenditure

in subsequent accounting periods and could be affected by changes in tax law.

(iii) Tax effect of exceptional items

The exceptional items included within the Company’s administrative expenses in the year ended 31 March 2007 were not

deductible for tax purposes.

F. Dividend

During the year the Company paid interim equity dividends of £30.9m (2007: £20.4m) to ordinary shareholders. The directors

propose a further dividend of 12 US cents per ordinary share for the year ended 31 March 2008. This dividend is not included as

a liability in the current year financial statements as it was not announced before 31 March 2008. For further details of payment

arrangements see note 14 in the Experian Group financial statements. Additionally, in the period ended 31 March 2007, there was

a dividend in specie of £3,497.5m relating to the demerger of Home Retail Group.

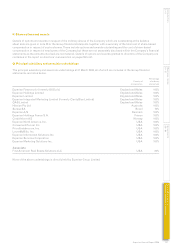

Notes to the parent company financial statements continued