Experian 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81Experian Annual Report 2008

Introduction

2 – 5

Business review

6 – 37

Governance

38 – 64

Financial statements

Group financial statements

Financial statements

Group financial statements

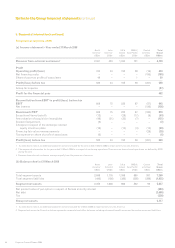

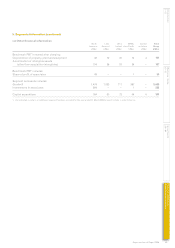

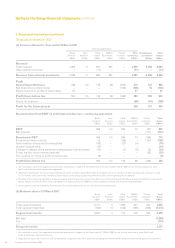

3. Financial risk management

The Group’s activities expose it to a variety of financial risks: market risk (including foreign exchange risk, interest rate

risk and price risk), credit risk and liquidity risk. The Group’s financial risk management focuses on the unpredictability of

financial markets and seeks to minimise potential adverse effects on the Group’s financial performance. The Group seeks to

reduce its exposure to financial risks and uses derivative financial instruments to hedge certain risk exposures.The Group

also ensures surplus funds are managed and controlled in a prudent manner which will protect capital sums invested and

ensure adequate short-term liquidity, whist maximising returns.

Prior to the demerger in October 2006, the Group transacted primarily in Sterling. The hedging and risk management

strategies pursued for the years then ended reflected this. Policies adopted since demerger reflect the increased significance

of the Group’s US Dollar operations.

Market risk

Foreign exchange risk

The Group operates internationally and is exposed to foreign exchange risk from future commercial transactions, recognised

assets and liabilities and investments in, and loans between, entities with different functional currencies. The Group

manages such risk, primarily within entities whose functional currencies are Sterling, by borrowing in the relevant foreign

currencies and using forward foreign exchange contracts. The principal transaction exposures are to the US Dollar and

the Euro.

The Group has investments in entities with other functional currencies, whose net assets are exposed to foreign exchange

translation risk. In order to reduce the impact of currency fluctuations on the value of such entities, the Group has a policy

of borrowing in US Dollars and Euros, as well as in Sterling and of entering into forward foreign exchange contracts in the

relevant currencies.

At 31 March 2008, if the US Dollar had strengthened/weakened by 6% (2007: 8%) against Sterling, with all other variables held

constant, profit for the financial year would have been US$1m (2007: n/a) higher/lower, and other components of equity would

have been unchanged.

At 31 March 2008, if the Euro had strengthened/weakened by 3% (2007: 2%) against Sterling, with all other variables held

constant, profit for the financial year would have been unchanged (2007: US$1m higher/lower), and other components of

equity would have been unchanged.

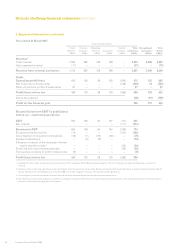

Interest rate risk

The Group’s interest rate risk arises principally from its net debt and the portions thereof at variable rates which expose the

Group to such risk.

The Group has a policy of normally maintaining between 30% and 70% of net debt at rates that are fixed for more than one

year. The Group’s interest rate exposure is managed by the use of fixed and floating rate borrowings and by the use of interest

rate swaps to adjust the balance of fixed and floating rate liabilities. The Group also mixes the duration of its borrowings to

smooth the impact of interest rate fluctuations.

At 31 March 2008, if interest rates on US Dollar denominated net debt had been 1.4% (2007: 1.4%) higher/lower with all other

variables held constant, profit for the financial year would have been US$8m (2007: US$12m) lower/higher, mainly as a result

of higher/lower interest on deposits and floating rate borrowings.

At 31 March 2008, if interest rates on Sterling denominated net debt had been 0.4% (2007: 0.4%) higher/lower with all other

variables held constant, profit for the financial year would have been US$8m (2007: US$8m) lower/higher, mainly as a result of

higher/lower interest on deposits and floating rate borrowings.

At 31 March 2008, if interest rates on Brazilian Real denominated net debt had been 2.4% (2007: 1.2%) higher/lower, with all

other variables held constant, profit for the financial year would have been US$1m (2007: n/a) lower/higher, mainly as a result

of higher/lower interest on deposits and floating rate borrowings.

At 31 March 2008, if interest rates on Euro denominated net debt had been 0.7% (2007: 0.4%) higher/lower with all other

variables held constant, profit for the financial year would have been US$3m (2007: US$1m) lower/higher, mainly as a result of

higher/lower interest on deposits and floating rate borrowings.