Experian 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Chairman’s statement

These have been extraordinary times

for the banking and financial services

industry. Unprecedented losses, huge

volatility, the dislocation of the inter-

bank lending market and subsequent

recapitalisation of major banks have

characterised the events of recent

months.

The extent to which the so-called

credit crunch will impact beyond the

financial sector remains to be seen,

but it is clear that this next year will be

another challenging one, particularly

for companies with exposure to the

US and UK markets, where the banks

will continue to be cautious lenders.

Within all sectors though, there

have been companies that have

performed well and I am pleased that

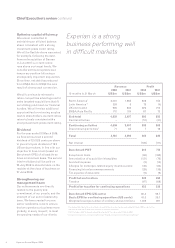

Experian is amongst these. Despite

the highly unusual conditions,

Experian delivered a solid financial

performance and continued to make

strong strategic progress, which is a

remarkable achievement.

Experian’s management was quick to

identify a range of efficiency measures

and to restructure certain parts of the

business so that it could better deal

with the prevailing conditions. This

will result in significant cost savings,

as well as delivering operational

efficiencies that will benefit us in the

longer term.

What this year has really shown is the

strength of Experian’s portfolio and

the many opportunities we have to

drive growth.

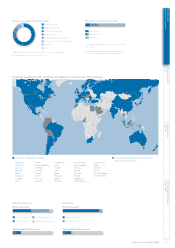

We have, for example, continued to

extend our global reach into new and

emerging markets. Our investment in

Serasa, Brazil’s largest credit bureau,

has provided us with a commanding

position in one of the fastest growing

credit markets in the world.

We have developed new and

innovative products for credit

managers and marketers, as well as

for consumers wanting to protect

their credit records. And we have

continued to expand into new market

sectors, such as government, energy,

telecommunications and healthcare.

In the UK alone, we won four

significant new contracts in the public

sector.

We have also made good progress

in the management of our corporate

responsibilities and in learning

how to embed these within our

everyday business processes.

Experian was selected for inclusion

in the FTSE4Good index of socially

responsible companies and the Dow

Jones Sustainability World Index.

Our carbon emissions continued

to fall, driven by improved energy

efficiency and the use of renewable

energy, and we played a leading role in

initiatives to reduce the incidence of

identity theft in the US and UK.

Experian’s performance this

year is undoubtedly testimony

to the underlying strength

of the business

2Experian Annual Report 2008