Experian 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 Experian Annual Report 2008

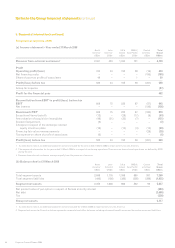

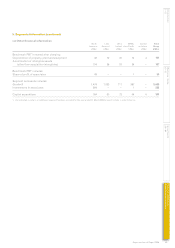

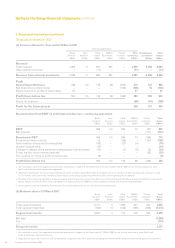

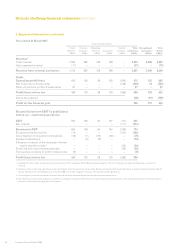

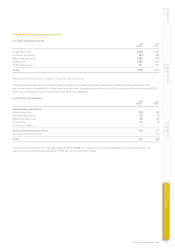

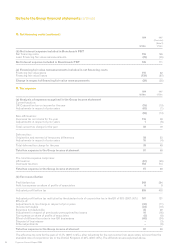

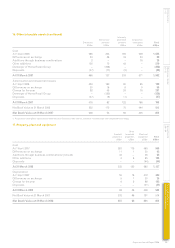

9. Exceptional and other non-GAAP measures

2008 2007

US$m US$m

Exceptional items

Restructuring costs 60 –

Charge on early vesting and modification of share awards at demerger of Experian and

Home Retail Group – 23

Other costs incurred relating to the demerger of Experian and Home Retail Group 6 126

Closure of UK Account Processing (2) 26

Loss on disposal of businesses 2 2

Gain arising in associate on the partial disposal of its subsidiary (3) (15)

Total exceptional items 63 162

Other non-GAAP measures

Amortisation of acquisition intangibles 121 76

Goodwill adjustment 2 14

Charges in respect of the demerger-related equity incentive plans 49 24

Financing fair value remeasurements (note 10) 29 35

Total other non-GAAP measures 201 149

Exceptional items and other non-GAAP measures are in respect of continuing operations.

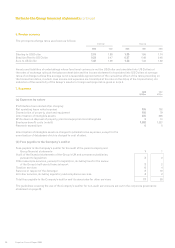

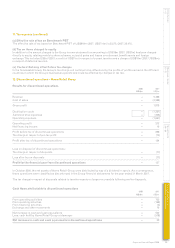

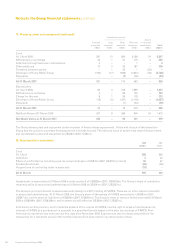

Exceptional items

In January 2008, the Group announced that it was launching a programme of significant cost-efficiency measures. Identified

efficiencies include offshoring of development activity, restructuring of core credit and marketing activities and infrastructure

consolidation. Following the identification of additional opportunities this programme is expected to deliver annualised cost

savings of approximately US$110m, of which an estimated US$50m is expected to be realised in the year ending 31 March 2009.

One-off restructuring costs associated with achieving these cost savings will be in the region of US$140m, the majority of

which will be cash costs. Costs of US$60m have been recognised in the year in connection with this programme with a related

cash outflow of US$18m. Of this charge, US$36m related to redundancy costs, US$12m related to asset write offs and US$12m

related to other restructuring and infrastructure consolidation costs.

Other costs relating to the demerger of Experian and Home Retail Group comprise legal and professional fees in respect of

the transaction, together with costs in connection with the cessation of the corporate functions of GUS plc.

In April 2006, Experian announced the phased withdrawal from large scale credit card and loan account processing in the UK.

The anticipated cost of withdrawal of US$26m was charged in the year ended 31 March 2007, and was made up of a cost in cash of

US$28m less the benefit of a US$2m pension curtailment credit. During the year ended 31 March 2008, an exceptional credit has

arisen in this connection following the successful transfer of certain employees and obligations of this business to a third party.

The loss on disposal of businesses in the year ended 31 March 2008 primarily related to the sale of Loyalty Solutions in

Germany and that in the year ended 31 March 2007 primarily related to the sale of a minority stake in Experian’s South African

business.

In the year ended 31 March 2007, First American Real Estate Solutions LLC (‘FARES’) recognised a gain of US$77m on the

partial disposal of its Real Estate Solutions division as part of the consideration for the acquisition of 82% of CoreLogic

Solutions, Inc. The Group recognised US$15m, its 20% share of the gain. A deferred tax charge of US$6m was included in

the FARES result for that year in respect of this gain. A further gain of US$3m has arisen in the year ended 31 March 2008 in

respect of a number of less significant disposals by FARES.

Cash outflows in respect of exceptional items of US$45m (2007: US$98m) comprise total exceptional items of US$63m (2007:

US$162m) adjusted for working capital movements of US$9m (2007: US$46m), asset write offs of US$12m (2007: US$3m),

share based payment add backs of US$nil (2007: US$30m) and gains in associates of US$3m (2007: US$15m).

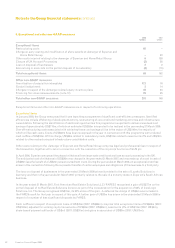

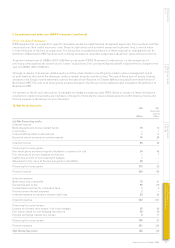

Notes to the Group financial statements continued