Experian 2008 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 200826

An element of the Group’s derivatives

is ineligible for hedge accounting

under IFRS. Gains or losses on

these derivatives arising from market

movements are charged or credited

to the Group income statement. In

the year ended 31 March 2008 this

amounted to a charge of US$29m

(2007: US$35m).

Pensions

At 31 March 2008 the Group has a

retirement benefit surplus for the

Experian defined benefit funded

schemes on an IAS 19 basis of

US$182m (2007: US$141m) and

separately reported pension

obligations of US$50m (2007:US$56m)

in respect of other schemes. Note 27

to the financial statements shows the

assumptions used together with the

other disclosures required by IAS 19.

Accounting policies and

standards

The principal accounting policies

used by the Group are shown in note 2

to the financial statements.

Use of non-GAAP measures

Experian has identified certain

measures that it believes provide

additional useful information on the

performance of the Group. As the

measures are not defined under IFRS

they may not be directly comparable

with other companies’ adjusted

measures. The non-GAAP measures

are not intended to be a substitute

for, or superior to, any IFRS measures

of performance. Certain non-GAAP

measures identified by the Group

are shown in note 2 to the financial

statements. Further non-GAAP

measures and reconciliations of those

measures are set out below.

Discontinuing activities:

Experian defines discontinuing

activities as businesses sold, closed

or identified for closure during a

financial year. These are treated

as discontinuing activities for

both revenue and EBIT purposes.

Comparative information is

restated to exclude the results

of discontinuing activities. This

financial measure differs from the

definition of discontinued operations

set out in IFRS 5 ‘Non-current assets

held for sale and discontinued

operations’.

Under IFRS 5, a discontinued

operation is defined as: (i) a

separate major line of business or

geographical area of operations;

(ii) part of a single plan to dispose

of a major line of business or

geographical area of operations; or

(iii) a subsidiary acquired exclusively

with a view to resale.

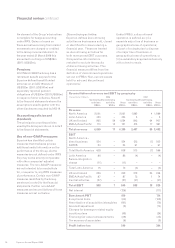

Reconciliation of revenue and EBIT by geography

12 months to 31 March 2008 2007

Continuing Discontinuing Continuing Discontinuing

activities activities Total activities activities Total

US$m US$m US$m US$m US$m US$m

Revenue

North America 2,061 – 2,061 1,985 4 1,989

Latin America 324 – 324 5 – 5

UK and Ireland 965 59 1,024 843 64 907

EMEA/Asia Pacific 710 12 721 574 17 591

Total revenue 4,059 71 4,130 3,407 85 3,492

EBIT

North America –

direct business 554 – 554 512 (7) 505

FARES 54 – 54 61 – 61

Total North America 608 – 608 573 (7) 566

Latin America 86 – 86 (4) – (4)

Serasa integration

charge (11) – (11) – – –

Total Latin America 75 – 75 (4) – (4)

UK and Ireland 226 7 232 212 24 236

EMEA/Asia Pacific 87 – 87 73 1 74

Central activities (57) – (57) (47) – (47)

Total EBIT 938 7 945 808 18 825

Net interest (126) (111)

Benchmark PBT 819 714

Exceptional items (63) (162)

Amortisation of acquisition intangibles (121) (76)

Goodwill adjustment (2) (14)

Charges for demerger-related equity

incentive plans (49) (24)

Financing fair value remeasurements (29) (35)

Tax expense of associates (6) (9)

Profit before tax 549 394

Financial review continued