Experian 2008 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.134 Experian Annual Report 2008

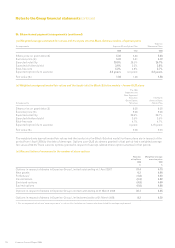

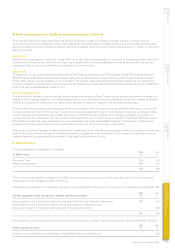

Notes to the parent company financial statements

for the year ended 31 March 2008

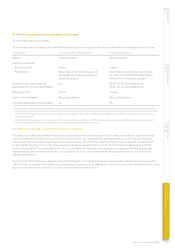

A. Corporate information

Experian Group Limited (the ‘Company’) is incorporated and registered in Jersey as a public company limited by shares. The

principal legislation under which the Company operates is Jersey Companies Law and regulations made thereunder.

The principal activity of the Company is to act as the ultimate holding company of the Experian Group (the ‘Group’), whose

principal activity is business services.

The shares of the Company are listed on the London Stock Exchange.

B. Basis of preparation and significant accounting policies

Basis of preparation

The separate financial statements of the Company are presented in compliance with the requirements for companies whose

shares are listed on the London Stock Exchange. The comparative figures cover the period from incorporation on 30 June

2006 to 31 March 2007. The financial statements are presented in Sterling as that is the functional currency of the Company. In

determining its functional currency the directors have determined the primary economic environment in which the Company

operates.

The financial statements have been prepared on a going concern basis and under the historical cost convention, modified

by the revaluation of certain financial instruments, and in accordance with the Companies (Jersey) Law 1991 and United

Kingdom Generally Accepted Accounting Practice (‘UK GAAP’).

These separately presented Company financial statements comprise the profit and loss account, balance sheet and related

notes. The Company has taken advantage of the exemption from preparing a cash flow statement under the terms of FRS 1

‘Cash Flow Statements’. The Company is also exempt under the terms of FRS 8 ‘Related Party Disclosures’ from disclosing

transactions with other members of the Group.

The Experian Group Limited consolidated financial statements for the year ended 31 March 2008 contain financial instrument

disclosures required by IFRS 7 ‘Financial Instruments: Disclosure and Presentation’ and these would also comply with the

disclosures required by FRS 29 ‘Financial Instruments: Disclosure and Presentation’. Accordingly, the Company has taken

advantage of the exemption in FRS 29 and has not presented separate financial instrument disclosures.

Significant accounting policies

The significant accounting policies of the Company are noted below.

Tangible fixed assets

Leasehold improvements are depreciated over the shorter of the estimated life of the asset and the remaining life of the lease.

Leases

Gross rental income receivable and payable in respect of operating leases is recognised on a straight line basis over the

periods of the leases.

Investments in group undertakings

Investments in group undertakings are stated at cost less provision considered necessary for any impairment.

Impairment of fixed assets

Where there is an indication of impairment, fixed assets are subject to review for impairment in accordance with FRS 11

‘Impairment of Fixed Assets and Goodwill’. Any impairment is recognised in the year in which it occurs.

Debtors and creditors

Debtors are initially recognised at fair value and carried at the lower of cost and recoverable amount. Where the time value

of money is material, debtors are carried at amortised cost. Creditors are initially recognised at fair value and carried at

amortised cost if the time value of money is material.

Cash

Cash includes cash in hand, deposits held at call with banks and other short-term highly liquid investments.

Accounting for derivative financial instruments

The Company uses forward foreign exchange contracts to manage its exposures to fluctuations in foreign exchange rates.