Experian 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 Experian Annual Report 2008

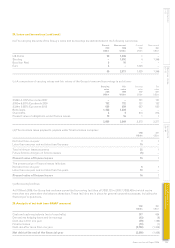

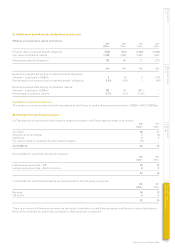

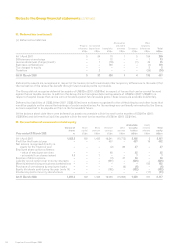

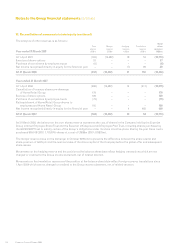

29. Other financial assets and liabilities

(a) The analysis of other financial assets and liabilities disclosed in the Group balance sheet is as follows:

Current Non-current Current Non-current

2008 2008 2007 2007

Other financial assets US$m US$m US$m US$m

Derivative financial instruments:

Fair value hedge of borrowings – interest rate swaps – 24 – 20

Fair value hedge of borrowings – cross currency swap – – 29 –

Non-hedging derivatives – interest rate swaps 2 – 3 16

Non-hedging derivatives – foreign exchange contracts 4 – 21 –

Total other financial assets 6 24 53 36

Current Non-current Current Non-current

2008 2008 2007 2007

Other financial liabilities US$m US$m US$m US$m

Derivative financial instruments:

Fair value hedge of borrowings – interest rate swaps – 20 – 40

Non-hedging derivatives – equity swaps 16 5 – –

Non-hedging derivatives – foreign exchange contracts 32 – – –

Non-hedging derivatives – interest rate swaps 2 66 – –

50 91 – 40

Put option in respect of acquisition of

Serasa minority interest – 583 – –

Total other financial liabilities 50 674 – 40

There is no material difference between the fair values of these assets and liabilities and the book values stated above.

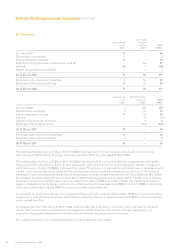

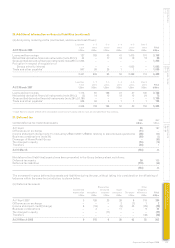

(b) Notional principal amounts at the balance sheet dates in respect of the Group’s derivative financial instruments are as follows:

2008 2007

US$m US$m

Interest rate swaps 3,443 2,814

Cross currency swap – 758

Equity swaps 72 –

Foreign exchange contracts 1,223 1,780

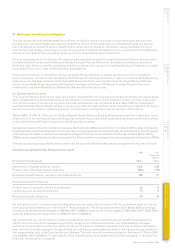

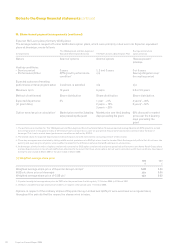

(c) Maturity of derivative financial instruments:

Less than 1 - 2 2 - 3 3 - 4 4 - 5 Over 5

1 year years years years years years To t a l

At 31 March 2008 US$m US$m US$m US$m US$m US$m US$m

Settled on a net basis:

Interest rate swaps 15 (5) 15 13 12 12 62

Equity swaps 19 5 2 – – – 26

34 – 17 13 12 12 88

Settled on a gross basis – foreign exchange contracts 1,223 – – – – – 1,223

1,257 – 17 13 12 12 1,311

Less than 1 - 2 2 - 3 3 - 4 4 - 5 Over 5

1 year years years years years years To t a l

At 31 March 2007 US$m US$m US$m US$m US$m US$m US$m

Settled on a net basis – interest rate swaps (5) 14 15 12 12 24 72

Settled on a gross basis – foreign exchange contracts 1,780 – – – – – 1,780

1,775 14 15 12 12 24 1,852

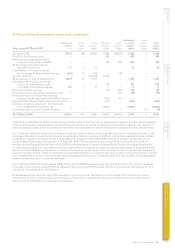

The table above analyses the Group’s derivative instruments, which will be settled on a gross and net basis, into relevant

maturity groupings based on the remaining period at the balance sheet date to the contractual maturity date. The amounts

disclosed are the contractual undiscounted cash flows.

Notes to the Group financial statements continued