Experian 2008 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 Experian Annual Report 2008

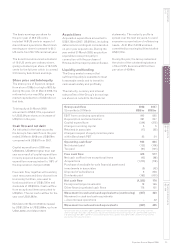

Organic growth Acquired growth EBIT

EMEA/Asia Pacific

EMEA/Asia Pacific performed well, reflecting

excellent progress in Experian’s credit bureaux

activities, significant expansion within Decision

Analytics and an increasingly material presence in

Marketing Services. Experian continues to invest in

the region to drive future growth.

Credit Services

Includes consumer credit bureaux in

ten countries, business information

bureaux in five countries and

transaction processing in France

Total revenue for Credit Services

grew 4% at constant exchange rates,

with organic revenue growth of 3%.

The acquisition contribution of 1%

reflected The pH Group. During the

year, Experian disposed of Loyalty

Solutions in Germany.

There were strong credit bureaux

performances across both

consumer and business information,

particularly in Southern and Eastern

Europe and South Africa. New

business wins in the year included

GE Money in Norway. At transaction

processing in France, business

process outsourcing performed well

and secured new business wins, as

did debit card processing. Cheque

processing performance was weak

as usage of cheques declines

in favour of debit card and other

payment options.

Decision Analytics

Includes credit analytics, decision

support software and fraud solutions

Decision Analytics performed very

strongly, with excellent organic

progress in the year, reflecting

Experian’s commitment to global

expansion. Total revenue growth at

constant exchange rates was 28%,

with organic revenue growth of 20%.

The acquisition contribution relates

to Tallyman.

There was strong demand for credit

decision products across many

markets, including in Western,

Southern and Eastern Europe, Japan,

Korea, China and Australia. There

was also good progress for fraud

solution services, such as Hunter,

particularly in the emerging markets

of Russia and Turkey which are

growing well off a small base. There

were new business wins in France,

Spain, South Africa, Japan and

Australia for both credit decision

and fraud prevention scores

and software.

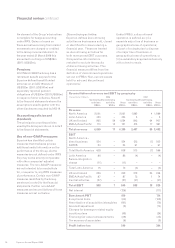

• Revenue from continuing

activities up 13% at

constant exchange rates;

7% organic

• EBIT from continuing

activities of US$87m, up

7% at constant exchange

rates

• EBIT margin of 12.3% after

investment in infrastructure

in Asia Pacific

• Excellent performances

from core credit activities,

reflecting strong credit

bureaux and Decision

Analytics momentum

• Increased scale in

Marketing Services

EBIT (US$m) and marginTotal revenue growth Organic revenue growth

7%08

07

06

05

04

7%

8%

8%

1%

Organic growth is defined as year-on-year revenue growth

at constant exchange rates, excluding acquisitions until the

date of their anniversary

11%

Organic growth Acquired growth

8%

18%

31%

13%

Total growth is defined as year-on-year revenue growth at

constant exchange rates

08

07

06

05

04

12.3%

12.7%

12.3%

12.2%

12.1%

EBIT excludes discontinuing activities

EBIT margin is for continuing activities only

08 87

07 73

06 64

05 59

04 47