Experian 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.76 Experian Annual Report 2008

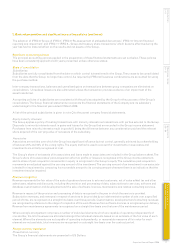

2. Basis of preparation and significant accounting policies (continued)

Cash flow hedges

The effective portion of changes in the fair value of derivatives that are designated and qualify as cash flow hedges is

recognised in equity. The gain or loss relating to the ineffective portion is recognised immediately within cost of sales or

operating expenses, as appropriate, in the Group income statement.

Amounts accumulated in equity are recycled in the Group income statement in the period when the hedged item will impact

the Group income statement. However, when the forecast transaction that is hedged results in the recognition of a non-

financial asset or liability, the gains and losses previously deferred in equity are transferred from equity and included in the

initial measurement of the cost of the asset or liability. When a hedging instrument expires or is sold, or when a hedge no

longer meets the criteria for hedge accounting, any cumulative gain or loss existing in equity at that time remains in equity

and is recognised when the forecast transaction is ultimately recognised in the Group income statement. When a forecast

transaction is no longer expected to occur, the cumulative gain or loss that was reported in equity is transferred immediately

to the Group income statement.

Net investment hedges

Any gain or loss on the hedging instrument relating to the effective portion of the hedge of a net investment in an entity

whose functional currency is not the US Dollar is recognised in equity; the gain or loss relating to the ineffective portion is

recognised immediately in net financing costs in the Group income statement. Gains and losses accumulated in equity are

included in the Group income statement when the entity is disposed of.

Non-hedging derivatives

Changes in the fair value of any derivative instrument that does not qualify for hedge accounting are recognised immediately

in the Group income statement. Costs in respect of derivatives entered into in connection with social security obligations on

employee share incentive schemes are charged as an employment cost; other changes are charged within financing fair value

remeasurements in the Group income statement.

Derivatives embedded in other financial instruments or other host contracts are treated as separate derivatives when their

risks and characteristics are not closely related to those of host contracts, and the host contracts are not carried at fair value

with unrealised gains or losses reported in the Group income statement.

Fair value estimation

The fair value of derivative financial instruments and other financial assets and liabilities is determined by using market data

and established estimation techniques such as discounted cash flow and option valuation models.

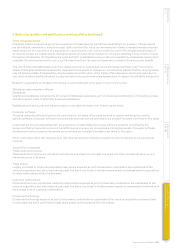

Impairment of non-financial assets

Assets that are not subject to amortisation are tested annually for impairment. Assets that are subject to amortisation

are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not

be recoverable. An impairment loss is recognised for the amount by which the asset’s carrying amount exceeds its

recoverable amount. The recoverable amount is the higher of an asset’s fair value less costs to sell, and value-in-use.

For the purposes of assessing impairment, assets are grouped at the lowest levels for which there are separately

identifiable cash flows which are CGUs.

Trade payables

Trade payables are recognised initially at fair value. Where the time value of money is material, payables are carried at

amortised cost.

Contingent consideration

Where part or all of the amount of purchase consideration is contingent on future events, the cost of the acquisition initially

recorded includes a reasonable estimate of the fair value of the contingent amounts expected to be payable in the future. The

cost of the acquisition is adjusted when revised estimates are made, with corresponding adjustments made to goodwill until

the ultimate outcome is known.

Where part or all of the amount of disposal consideration is contingent on future events, the disposal proceeds initially

recorded include a reasonable estimate of the fair value of the contingent amounts expected to be receivable in the future.

The proceeds are adjusted when revised estimates are made, with corresponding adjustments made to debtors, and profit

and loss on disposal, until the ultimate outcome is known.

Notes to the Group financial statements continued