Experian 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8Experian Annual Report 2008

Optimise capital efficiency

We remain committed to

maintaining an efficient balance

sheet, consistent with a strong

investment grade credit rating.

We will be flexible where warranted,

for example, following the debt-

financed acquisition of Serasa

in June 2007 our credit ratios

rose above our target levels. We

considered this acceptable as a

temporary position following a

strategically important acquisition.

Since then, net debt has reduced

from US$3.0bn to US$2.7bn as a

result of strong cash conversion.

We will continue to reinvest to

retain competitive advantage and to

make targeted acquisitions that fit

our strategy and meet our financial

hurdles. We will review additional

opportunities for returning surplus

cash to shareholders, as credit ratios

return to levels consistent with a

strong investment grade credit rating.

Dividend

For the year ended 31 March 2008,

we have announced a second

dividend of 12.0 US cents per share

to give a full year dividend of 18.5

US cents per share, in line with our

objective to have cover (based on

Benchmark EPS) of at least three

times on an annual basis. The second

interim dividend will be paid on

25 July 2008 to shareholders on the

register at the close of business on

27 June 2008.

Strengthening our

management team

Our achievements are directly

related to the quality and

commitment of our people, and the

strength of our senior leadership

team. We have created two new

senior leadership roles to ensure

that we operate our business more

globally, in every respect, to meet

the growing needs of our clients.

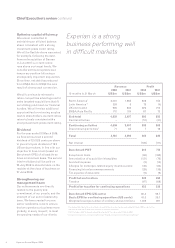

Revenue Profit

2008 2007 2008 2007

12 months to 31 March US$m US$m US$m US$m

North America1 2,061 1,985 608 573

Latin America1,2 324 5 75 (4)

UK and Ireland 965 843 226 212

EMEA/Asia Pacific 710 574 87 73

Sub total 4,059 3,407 995 855

Central activities – – (57) (47)

Continuing activities 4,059 3,407 938 808

Discontinuing activities3 71 85 7 18

Total 4,130 3,492 945 825

Net interest (126) (111)

Benchmark PBT 819 714

Exceptional items (63) (162)

Amortisation of acquisition intangibles (121) (76)

Goodwill expense (2) (14)

Charges for demerger-related equity incentive plans (49) (24)

Financing fair value remeasurements (29) (35)

Tax expense of associate (6) (9)

Profit before taxation 549 394

Taxation (97) (68)

Profit after taxation for continuing operations 452 326

Benchmark EPS (US cents) 60.3 59.7

Basic EPS for continuing operations (US cents) 43.3 35.1

Weighted average number of ordinary shares (million) 1,009 927

1 The segmental information presented in respect of the Americas for the year ended 31 March 2007 is now further

analysed to show North and Latin America as separate segments

2 Profit includes US$11m Serasa integration charge for the year ended 31 March 2008

3 Discontinuing activities include MetaReward, UK account processing and Loyalty Solutions

Experian is a strong

business performing well

in difficult markets

Chief Executive’s review continued