Experian 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113Experian Annual Report 2008

Introduction

2 – 5

Business review

6 – 37

Governance

38 – 64

Financial statements

Group financial statements

Financial statements

Group financial statements

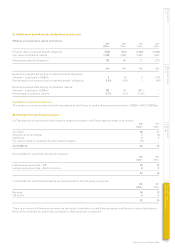

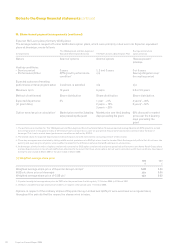

29. Other financial assets and liabilities (continued)

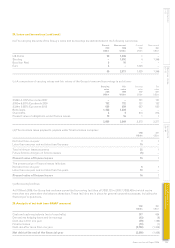

(d) Fair values of other financial assets and liabilities

Fair values of derivative instruments are set out in note (a) opposite.

The fair value of foreign currency contracts is based on a comparison of the contractual and year end exchange rates. The fair

values of other derivative financial instruments are estimated by discounting the future cash flows to net present values using

appropriate market rates prevailing at the year end.

The put option associated with the remaining 30% stake of Serasa is recognised as a liability of US$583m at 31 March 2008

under IAS 39. The put element is valued at the higher of 95% of the equity value of Serasa or the value of Serasa based on the

P/E ratio of Experian and the latest earnings of Serasa. A Monte Carlo simulation has been used to calculate the liability. The

key assumptions in arriving at the value of the put are the equity value of Serasa, the future P/E ratio of Experian at the date of

exercise, the respective volatilities of Experian and Serasa and the risk free rate in Brazil.

The method of valuation has been updated since the initial recognition of the liability as it is now assumed that the put may be

exercised in June 2012 and thereafter recorded as a current liability. Previously an average assumed exercise date of June 2015

had been applied. This change in method resulted in an increase of US$117m to the initial liability recognised at the date of the

written put on acquisition of Serasa and has no impact on the results previously reported at 30 September 2007. The gain since

acquisition of US$69m, which is recorded as a financing fair value remeasurement, primarily relates to a fall of 7 in the expected

future Experian P/E ratio during the period since acquisition and an increase in the risk free rate in Brazil from 10.4% to 13.2%.

(e) Amounts recognised in the Group income statement in connection with the Group’s hedging instruments are disclosed in note 10.

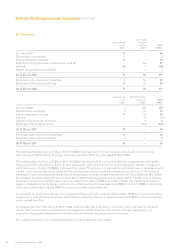

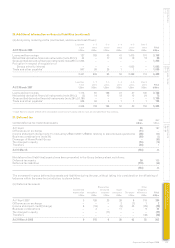

30. Additional information on financial liabilities

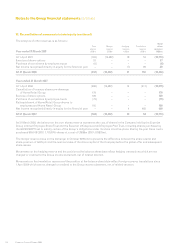

(a) The contractual repricing dates of liabilities exposed to interest rate risk are as follows:

Less than 1 - 2 2 - 3 3 - 4 4 - 5 Over 5

1 year years years years years years To t a l

At 31 March 2008 US$m US$m US$m US$m US$m US$m US$m

Loans and borrowings

£350m 6.375% Eurobonds 2009 – 732 – – – – 732

£334m 5.625% Euronotes 2013 – – – – – 660 660

Bank loans 1,438 – – – – – 1,438

Overdrafts 4 – – – – – 4

Present value of obligations under finance leases 6 5 4 1 – – 16

Effect of interest rate swaps1 (185) (210) 475 379 209 (668) –

Other derivative financial liabilities 50 15 21 26 9 20 141

Put option in respect of acquisition of

Serasa minority interest 583 – – – – – 583

Trade and other payables2 944 25 23 1 – – 993

2,840 567 523 407 218 12 4,567

Less than 1 - 2 2 - 3 3 - 4 4 - 5 Over 5

1 year years years years years years To t a l

At 31 March 2007 US$m US$m US$m US$m US$m US$m US$m

Loans and borrowings

€548m 4.125% Euronotes 2007 751 – – – – – 751

£350m 6.375% Eurobonds 2009 – – 721 – – – 721

£334m 5.625% Euronotes 2013 – – – – – 627 627

Overdrafts 273 – – – – – 273

Present value of obligations under finance leases 1 – – – – – 1

Effect of interest rate swaps1 130 408 (272) 390 – (656) –

Other derivative financial liabilities 40 – – – – – 40

Trade and other payables2 714 46 3 1 1 1 766

1,909 454 452 391 1 (28) 3,179

1. These represent the gross notional values of interest rate swaps.

2. VAT and other tax payable of US$52m (2007: US$42m), social security costs of US$95m (2007: US$75m) and accruals of US$196m (2007: US$200m) are included

in trade and other payables in note 23 but are excluded from this analysis.