Xerox 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The principal value of the U.S. receivables derecognized from our balance sheet was $761 and $644 at December 31,

2013 and 2012, respectively (sales value of approximately $833 and $715, respectively).

The beneficial interest represents our right to receive future cash flows from the sold receivables, which exceed the

servicing fee as well as the ultimate purchaser's initial investment and associated return on that investment. The

beneficial interest was initially recognized at an estimate of fair value based on the present value of the expected future

cash flows. The present value of the expected future cash flows was calculated using management's best estimate of

key assumptions including credit losses, prepayment rate and an appropriate risk adjusted discount rate (all

unobservable Level 3 inputs) for which we utilized annualized rates of 2.1%, 9.3% and 10.0%, respectively. These

assumptions are supported by both our historical experience and anticipated trends relative to the particular portfolio of

receivables sold. However, to assess the sensitivity on the fair value of the beneficial interest, we adjusted the credit

loss rate, prepayment rate and discount rate assumptions individually by 10% and 20% while holding the other

assumptions constant. Although the effect of multiple assumption changes was not considered in this analysis, a 10% or

20% adverse variation in any one of these three individual assumptions would have decreased the initially recorded

beneficial interest by approximately $3 or less for sales in 2013 and $4 or less for sales in 2012.

We will continue to service the sold receivables for which we receive a 1% servicing fee. We have concluded that the

1% servicing fee is adequate compensation and, accordingly, no servicing asset or liability was recorded.

Canada Lease Finance Receivables Transfer: In December 2013, our Canadian subsidiary transferred its entire

interest in a group of lease finance receivables to a third-party trust. The transfer was accounted for as a sale and

resulted in the derecognition of lease receivables with a net carrying value of $257, net of allowance of $5, the receipt of

cash proceeds of $248 and a beneficial interest of $26. A pre-tax gain of $15 was recognized on this transaction and is

net of additional fees and expenses of approximately $1. We will continue to service the sold receivables for which we

will receive a 1% servicing fee. We have concluded that the 1% servicing fee is adequate compensation and,

accordingly, no servicing asset or liability was recorded. The principal value of the Canadian receivables derecognized

from our balance sheet was $245 at December 31, 2013 (sale value of approximately $265).

Consistent with the U.S. transfers, the beneficial interest was initially recognized at an estimate of fair value based on

the present value of the expected future cash flows. The present value of the expected future cash flows was calculated

using management's best estimate of key assumptions including credit losses, prepayment rate and an appropriate risk

adjusted discount rate (all unobservable Level 3 inputs) for which we utilized annualized rates of 1.7%, 12.0% and

10.0%, respectively. These assumptions are supported by both our historical experience and anticipated trends relative

to the particular portfolio of receivables sold. However, to assess the sensitivity on the fair value of the beneficial

interest, we adjusted the credit loss rate, prepayment rate and discount rate assumptions individually by 10% and 20%

while holding the other assumptions constant. Although the effect of multiple assumption changes was not considered in

this analysis, a 10% or 20% adverse variation in any one of these three individual assumptions would have decreased

the initially recorded beneficial interest by approximately $1 or less.

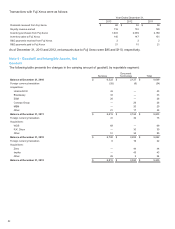

Summary Finance Receivable Sales The lease portfolios transferred and sold were all from our Document Technology

segment and the gains on these sales were reported in Financing revenues within the Document Technology segment.

The ultimate purchaser has no recourse to our other assets for the failure of customers to pay principal and interest

when due beyond our beneficial interests which were $150 and $103 at December 31, 2013 and 2012, respectively, and

are included in Other current assets and Other long-term assets accordingly in the accompanying Consolidated Balance

Sheets. Beneficial interests of $124 and $103 at December 31, 2013 and 2012, respectively, are held by the

bankruptcy-remote subsidiaries and therefore are not available to satisfy any of our creditor obligations. We report

collections on the beneficial interests as operating cash flows in the Consolidated Statements of Cash Flows because

such beneficial interests are the result of an operating activity and the associated interest rate risk is de minimis

considering their weighted average lives of less than 2 years.

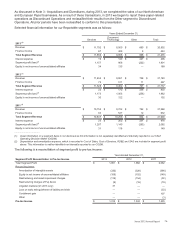

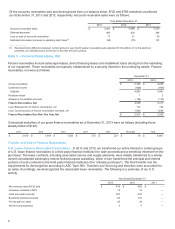

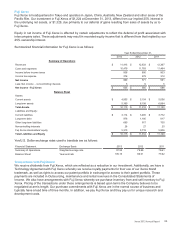

The net impact from the sales of finance receivables on operating cash flows is summarized below:

Year Ended December 31,

2013 2012 2011

Net cash received for sales of finance receivables(1) $631 $625 $ —

Impact from prior sales of finance receivables(2) (392)(45) —

Collections on beneficial interest 58 ——

Estimated Increase to Operating Cash Flows $297 $580 $ —

_________________

(1) Net of beneficial interest, fees and expenses.

(2) Represents cash that would have been collected if we had not sold finance receivables.

Xerox 2013 Annual Report 82