Xerox 2013 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

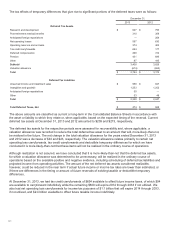

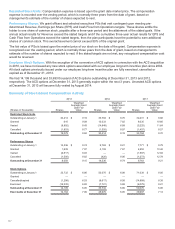

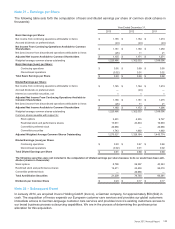

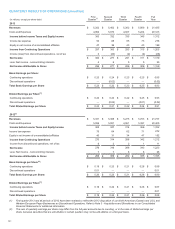

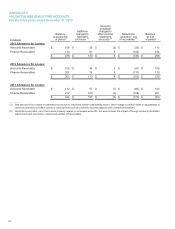

Note 21 – Earnings per Share

The following table sets forth the computation of basic and diluted earnings per share of common stock (shares in

thousands):

Year Ended December 31,

2013 2012 2011

Basic Earnings per Share:

Net income from continuing operations attributable to Xerox $1,185 $1,184 $1,274

Accrued dividends on preferred stock (24)(24)(24)

Net Income From Continuing Operations Available to Common

Shareholders $1,161 $1,160 $1,250

Net (loss) income from discontinued operations attributable to Xerox (26) 11 21

Adjusted Net Income Available to Common Shareholders $1,135 $1,171 $1,271

Weighted-average common shares outstanding 1,225,486 1,302,053 1,388,096

Basic Earnings (Loss) per Share:

Continuing operations $0.95 $0.89 $0.90

Discontinued operations (0.02)0.01 0.02

Total Basic Earnings per Share $0.93 $0.90 $0.92

Diluted Earnings per Share:

Net income from continuing operations attributable to Xerox $1,185 $1,184 $1,274

Accrued dividends on preferred stock — (24)—

Interest on convertible securities, net 11 1

Adjusted Net Income From Continuing Operations Available to

Common Shareholders $1,186 $1,161 $1,275

Net (loss) income from discontinued operations attributable to Xerox (26) 11 21

Adjusted Net Income Available to Common Shareholders $1,160 $1,172 $1,296

Weighted-average common shares outstanding 1,225,486 1,302,053 1,388,096

Common shares issuable with respect to:

Stock options 5,401 4,335 9,727

Restricted stock and performance shares 13,931 20,804 16,993

Convertible preferred stock 26,966 — 26,966

Convertible securities 1,743 1,992 1,992

Adjusted Weighted Average Common Shares Outstanding 1,273,527 1,329,184 1,443,774

Diluted Earnings (Loss) per Share:

Continuing operations $0.93 $0.87 $0.88

Discontinued operations (0.02)0.01 0.02

Total Diluted Earnings per Share $0.91 $0.88 $0.90

The following securities were not included in the computation of diluted earnings per share because to do so would have been anti-

dilutive (shares in thousands):

Stock options 8,798 29,397 40,343

Restricted stock and performance shares 12,411 23,430 26,018

Convertible preferred stock — 26,966 —

Total Anti-Dilutive Securities 21,209 79,793 66,361

Dividends per Common Share $0.23 $0.17 $0.17

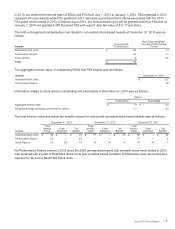

Note 22 – Subsequent Event

In January 2014, we acquired Invoco Holding GmbH (Invoco), a German company, for approximately $59 (€42) in

cash. The acquisition of Invoco expands our European customer care services and provides our global customers

immediate access to German-language customer care services and provides Invoco’s existing customers access to

our broad business process outsourcing capabilities. We are in the process of determining the purchase price

allocation for this acquisition.

Xerox 2013 Annual Report

120