Xerox 2013 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

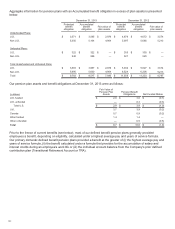

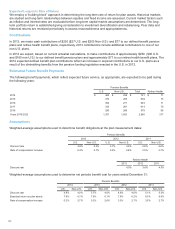

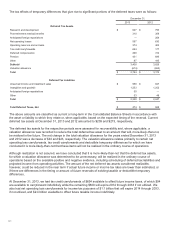

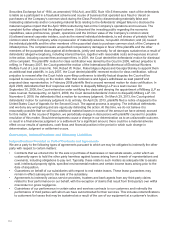

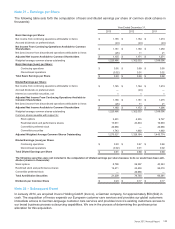

The tax effects of temporary differences that give rise to significant portions of the deferred taxes were as follows:

December 31,

2013 2012

Deferred Tax Assets

Research and development $ 647 $793

Post-retirement medical benefits 310 359

Anticipated foreign repatriations — 264

Net operating losses 597 630

Operating reserves and accruals 374 403

Tax credit carryforwards 694 177

Deferred compensation 268 312

Pension 431 696

Other 87 195

Subtotal 3,408 3,829

Valuation allowance (614)(654)

Total $2,794 $3,175

Deferred Tax Liabilities

Unearned income and installment sales $ 959 $947

Intangibles and goodwill 1,253 1,252

Anticipated foreign repatriations 55 —

Other 53 48

Total $2,320 $2,247

Total Deferred Taxes, Net $474 $928

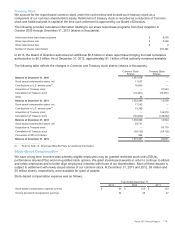

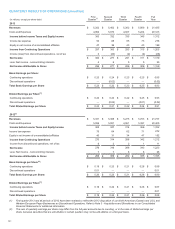

The above amounts are classified as current or long-term in the Consolidated Balance Sheets in accordance with

the asset or liability to which they relate or, when applicable, based on the expected timing of the reversal. Current

deferred tax assets at December 31, 2013 and 2012 amounted to $209 and $273, respectively.

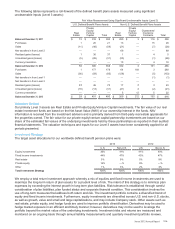

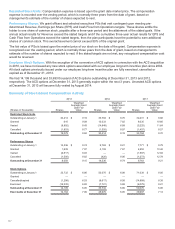

The deferred tax assets for the respective periods were assessed for recoverability and, where applicable, a

valuation allowance was recorded to reduce the total deferred tax asset to an amount that will, more-likely-than-not,

be realized in the future. The net change in the total valuation allowance for the years ended December 31, 2013

and 2012 was a decrease of $40 and $23, respectively. The valuation allowance relates primarily to certain net

operating loss carryforwards, tax credit carryforwards and deductible temporary differences for which we have

concluded it is more-likely-than-not that these items will not be realized in the ordinary course of operations.

Although realization is not assured, we have concluded that it is more-likely-than-not that the deferred tax assets,

for which a valuation allowance was determined to be unnecessary, will be realized in the ordinary course of

operations based on the available positive and negative evidence, including scheduling of deferred tax liabilities and

projected income from operating activities. The amount of the net deferred tax assets considered realizable,

however, could be reduced in the near term if actual future income or income tax rates are lower than estimated, or

if there are differences in the timing or amount of future reversals of existing taxable or deductible temporary

differences.

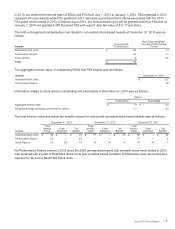

At December 31, 2013, we had tax credit carryforwards of $694 available to offset future income taxes, of which $94

are available to carryforward indefinitely while the remaining $600 will expire 2014 through 2033 if not utilized. We

also had net operating loss carryforwards for income tax purposes of $1.1 billion that will expire 2014 through 2033,

if not utilized, and $2.4 billion available to offset future taxable income indefinitely.

111