Xerox 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

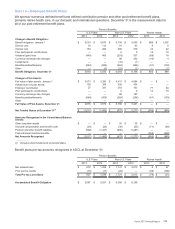

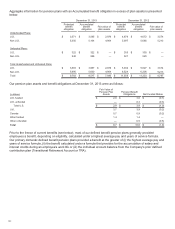

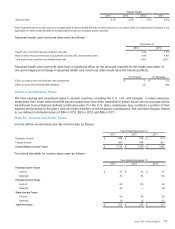

Note 15 – Employee Benefit Plans

We sponsor numerous defined benefit and defined contribution pension and other post-retirement benefit plans,

primarily retiree health care, in our domestic and international operations. December 31 is the measurement date for

all of our post-retirement benefit plans.

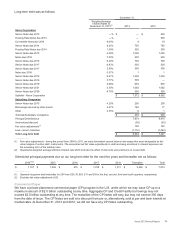

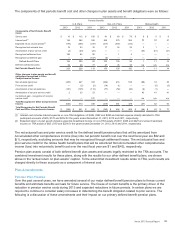

Pension Benefits

U.S. Plans Non-U.S. Plans Retiree Health

2013 2012 2013 2012 2013 2012

Change in Benefit Obligation:

Benefit obligation, January 1 $ 5,033 $4,670 $6,708 $5,835 $989 $ 1,007

Service cost 10 112 91 83 9 9

Interest cost 154 282 260 270 33 42

Plan participants' contributions — — 6 914 19

Actuarial (gain) loss (440)480 (203)537 (88) 18

Currency exchange rate changes — — 98 232 (10)4

Curtailments — — (10) (1) — —

Benefits paid/settlements (864)(509)(264)(256)(91) (103)

Other — (2) (22) (1) — (7)

Benefit Obligation, December 31 $3,893 $5,033 $6,664 $6,708 $856 $ 989

Change in Plan Assets:

Fair value of plan assets, January 1 $ 3,573 $3,393 $5,431 $4,884 $ — $ —

Actual return on plan assets 139 358 326 434 — —

Employer contribution 27 331 203 163 77 84

Plan participants' contributions — — 6 914 19

Currency exchange rate changes — — 88 197 — —

Benefits paid/settlements (864)(509)(264)(256)(91) (103)

Other 1— (1) — — —

Fair Value of Plan Assets, December 31 $2,876 $3,573 $5,789 $5,431 $ — $ —

Net Funded Status at December 31(1) $(1,017) $ (1,460) $ (875) $ (1,277) $ (856) $ (989)

Amounts Recognized in the Consolidated Balance

Sheets:

Other long-term assets $ — $ — $ 55 $ 35 $ — $ —

Accrued compensation and benefit costs (25)(23)(30)(25)(71) (80)

Pension and other benefit liabilities (992) (1,437) (900) (1,287) — —

Post-retirement medical benefits — — — — (785) (909)

Net Amounts Recognized $(1,017) $ (1,460) $ (875) $ (1,277) $ (856) $ (989)

_______________

(1) Includes under-funded and un-funded plans.

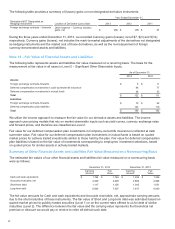

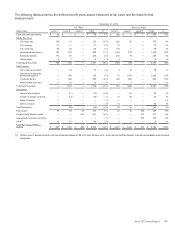

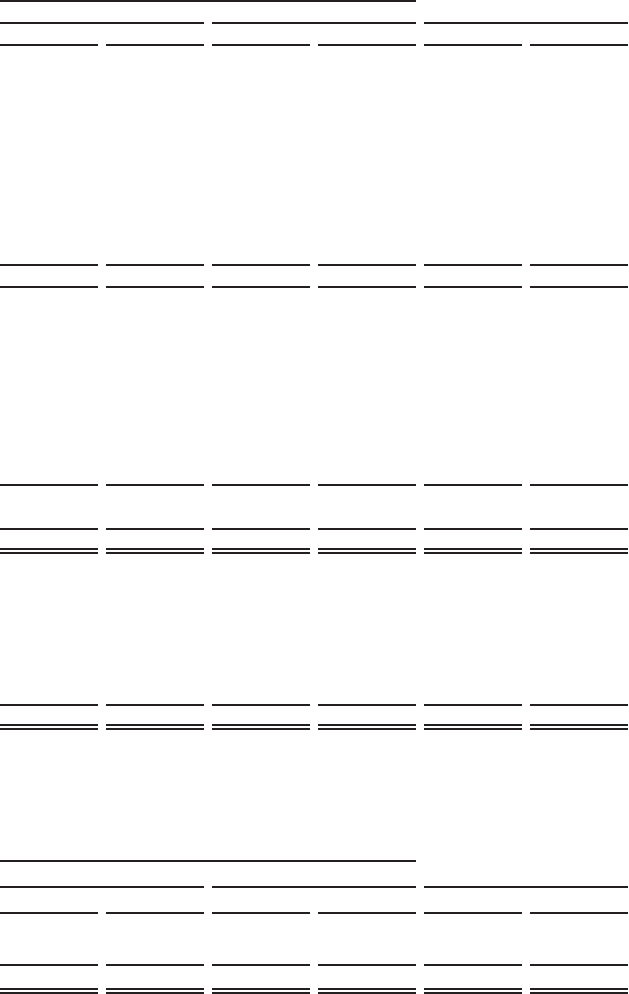

Benefit plans pre-tax amounts recognized in AOCL at December 31:

Pension Benefits

U.S. Plans Non-U.S. Plans Retiree Health

2013 2012 2013 2012 2013 2012

Net actuarial loss $ 672 $1,255 $1,741 $2,013 $6$ 97

Prior service credits (15)(17)(20) — (85) (128)

Total Pre-tax Loss (Gain) $657 $1,238 $1,721 $2,013 $(79) $ (31)

Accumulated Benefit Obligation $3,887 $5,027 $6,368 $6,359

Xerox 2013 Annual Report

100