Xerox 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.longer than five years. There is no significant after-market for our used equipment. We believe five years is

representative of the period during which the equipment is expected to be economically usable, with normal service,

for the purpose for which it is intended. Residual values are not significant.

With respect to fair value, we perform an analysis of equipment fair value based on cash selling prices during the

applicable period. The cash selling prices are compared to the range of values determined for our leases. The

range of cash selling prices must be reasonably consistent with the lease selling prices in order for us to determine

that such lease prices are indicative of fair value.

Financing: Finance income attributable to sales-type leases, direct financing leases and installment loans is

recognized on the accrual basis using the effective interest method.

Services-Related Revenue

Outsourcing: Revenues associated with outsourcing services are generally recognized as services are rendered,

which is generally on the basis of the number of accounts or transactions processed. Information technology

processing revenues are recognized as services are provided to the customer, generally at the contractual selling

prices of resources consumed or capacity utilized by our customers. In those service arrangements where final

acceptance of a system or solution by the customer is required, revenue is deferred until all acceptance criteria

have been met. Revenues on cost reimbursable contracts are recognized by applying an estimated factor to costs

as incurred, determined by the contract provisions and prior experience. Revenues on unit-price contracts are

recognized at the contractual selling prices as work is completed and accepted by the customer. Revenues on time

and material contracts are recognized at the contractual rates as the labor hours and direct expenses are incurred.

Revenues on certain fixed price contracts where we provide system development and implementation services are

recognized over the contract term based on the percentage of development and implementation services that are

provided during the period compared with the total estimated development and implementation services to be

provided over the entire contract using the percentage-of-completion accounting methodology. These services

require that we perform significant, extensive and complex design, development, modification or implementation of

our customers' systems. Performance will often extend over long periods, and our right to receive future payment

depends on our future performance in accordance with the agreement.

The percentage-of-completion methodology involves recognizing probable and reasonably estimable revenue using

the percentage of services completed, on a current cumulative cost to estimated total cost basis, using a reasonably

consistent profit margin over the period.

Revenues earned in excess of related billings are accrued, whereas billings in excess of revenues earned are

deferred until the related services are provided. We recognize revenues for non-refundable, upfront implementation

fees on a straight-line basis over the period between the initiation of the ongoing services through the end of the

contract term.

In connection with our services arrangements, we incur and capitalize costs to originate these long-term contracts

and to perform the migration, transition and setup activities necessary to enable us to perform under the terms of

the arrangement. Certain initial direct costs of an arrangement are capitalized and amortized over the contractual

service period of the arrangement to cost of services.

From time to time, we also provide inducements to customers in various forms, including contractual credits, which

are capitalized and amortized as a reduction of revenue over the term of the contract. Customer-related deferred

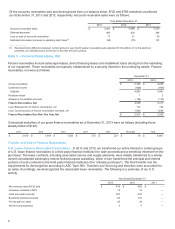

set-up/transition and inducement costs were $399 and $356 at December 31, 2013 and 2012, respectively, and the

balance at December 31, 2013 is expected to be amortized over a weighted average period of approximately 6

years. Amortization expense associated with customer-related contract costs at December 31, 2013 is expected to

be approximately $132 in 2014.

Long-lived assets used in the fulfillment of the arrangements are capitalized and depreciated over the shorter of

their useful life or the term of the contract if an asset is contract specific.

Our outsourcing services contracts may also include the sale of equipment and software. In these instances we

follow the policies noted above under Equipment-Related Revenue.

71