Xerox 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

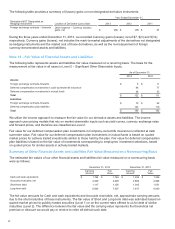

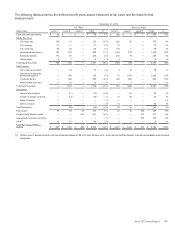

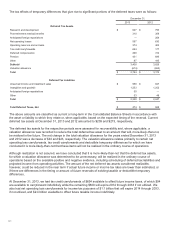

The following tables represents a roll-forward of the defined benefit plans assets measured using significant

unobservable inputs (Level 3 assets):

Fair Value Measurement Using Significant Unobservable Inputs (Level 3)

U.S. Defined Benefit Plans Assets Non-U.S. Defined Benefit Plans Assets

Real

Estate

Private

Equity/

Venture

Capital Total

Real

Estate

Private

Equity/

Venture

Capital

Guaranteed

Insurance

Contracts Total

Balance at December 31, 2011 $72 $318 $390 $280 $3$116 $ 399

Purchases 1 20 21 13 — 15 28

Sales (11) (48)(59)(21) — (7) (28)

Net transfers in from Level 2 — — — 69 — — 69

Realized gains (losses) 1 36 37 1 — 4 5

Unrealized gains (losses) (5)(26)(31)(25) — (1) (26)

Currency translation — — — 15 — 419

Balance at December 31, 2012 58 300 358 332 3 131 466

Purchases 1 177 178 64 193 3 260

Sales (36) (59)(95)(128) — (5) (133)

Net transfers in from Level 1 — — — — — (1) (1)

Net transfers in from Level 2 — — — — — — —

Realized gains (losses) 24 46 70 17 2 4 23

Unrealized gains (losses) (18) (13)(31)(21)2(2) (21)

Currency translation — — — 5 12 522

Balance at December 31, 2013 $29 $451 $480 $269 $212 $135 $ 616

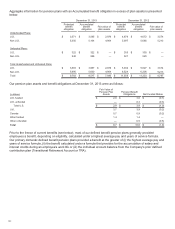

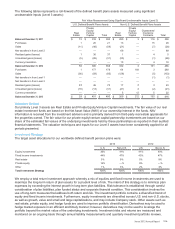

Valuation Method

Our primary Level 3 assets are Real Estate and Private Equity/Venture Capital investments. The fair value of our real

estate investment funds are based on the Net Asset Value (NAV) of our ownership interest in the funds. NAV

information is received from the investment advisers and is primarily derived from third-party real estate appraisals for

the properties owned. The fair value for our private equity/venture capital partnership investments are based on our

share of the estimated fair values of the underlying investments held by these partnerships as reported in their audited

financial statements. The valuation techniques and inputs for our Level 3 assets have been consistently applied for all

periods presented.

Investment Strategy

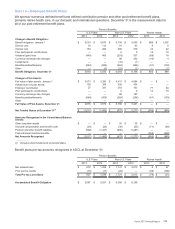

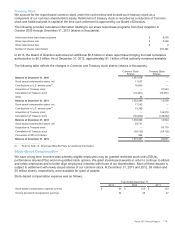

The target asset allocations for our worldwide defined benefit pension plans were:

2013 2012

U.S. Non-U.S. U.S. Non-U.S.

Equity investments 36% 41% 41% 40%

Fixed income investments 44% 47% 43% 47%

Real estate 5% 9% 5% 9%

Private equity 14% —% 9% —%

Other 1% 3% 2% 4%

Total Investment Strategy 100% 100% 100% 100%

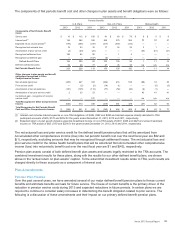

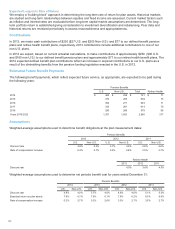

We employ a total return investment approach whereby a mix of equities and fixed income investments are used to

maximize the long-term return of plan assets for a prudent level of risk. The intent of this strategy is to minimize plan

expenses by exceeding the interest growth in long-term plan liabilities. Risk tolerance is established through careful

consideration of plan liabilities, plan funded status and corporate financial condition. This consideration involves the

use of long-term measures that address both return and risk. The investment portfolio contains a diversified blend of

equity and fixed income investments. Furthermore, equity investments are diversified across U.S. and non-U.S. stocks,

as well as growth, value and small and large capitalizations, and may include Company stock. Other assets such as

real estate, private equity, and hedge funds are used to improve portfolio diversification. Derivatives may be used to

hedge market exposure in an efficient and timely manner; however, derivatives may not be used to leverage the

portfolio beyond the market value of the underlying investments. Investment risks and returns are measured and

monitored on an ongoing basis through annual liability measurements and quarterly investment portfolio reviews.

Xerox 2013 Annual Report

106