Xerox 2013 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

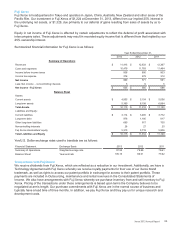

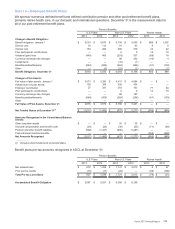

Summary of Derivative Instruments Fair Value: The following table provides a summary of the fair value amounts

of our derivative instruments:

December 31,

Designation of Derivatives Balance Sheet Location 2013 2012

Derivatives Designated as Hedging Instruments

Foreign exchange contracts – forwards Other current assets $ 1$3

Other current liabilities (51)(51)

Net Designated Derivative Liability $(50) $ (48)

Derivatives NOT Designated as Hedging Instruments

Foreign exchange contracts – forwards Other current assets $ 5$8

Other current liabilities (19)(31)

Net Undesignated Derivative Liability $(14) $ (23)

Summary of Derivatives Total Derivative Assets $ 6$ 11

Total Derivative Liabilities (70)(82)

Net Derivative Liability $(64) $ (71)

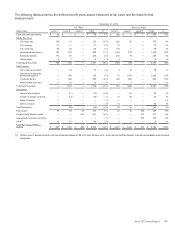

Summary of Derivative Instruments Gains (Losses)

Derivative gains and (losses) affect the income statement based on whether such derivatives are designated as

hedges of underlying exposures. The following is a summary of derivative gains and (losses).

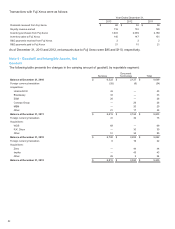

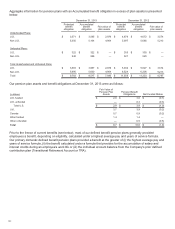

Designated Derivative Instruments Gains (Losses): The following tables provide a summary of gains (losses) on

derivative instruments:

Year Ended December 31,

Derivatives in Fair Value

Relationships

Location of Gain (Loss)

Recognized in Income

Derivative Gain (Loss)

Recognized in Income

Hedged Item Gain (Loss)

Recognized in Income

2013 2012 2011 2013 2012 2011

Interest rate contracts Interest expense $ — $ — $ 15 $ — $ — $ (15)

Year Ended December 31,

Derivatives in Cash

Flow

Hedging Relationships

Derivative Gain (Loss) Recognized in OCI

(Effective Portion)

Location of Derivative

Gain (Loss)

Reclassified

from AOCI into Income

(Effective Portion)

Gain (Loss) Reclassified from AOCI to

Income (Effective Portion)

2013 2012 2011 2013 2012 2011

Foreign exchange

contracts – forwards $ (126) $ (50) $ 30 Cost of sales $ (123) $ 37 $ 14

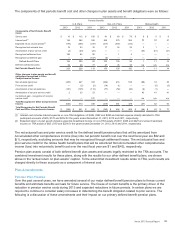

No amount of ineffectiveness was recorded in the Consolidated Statements of Income for these designated cash

flow hedges and all components of each derivative’s gain or (loss) were included in the assessment of hedge

effectiveness. In addition, no amount was recorded for an underlying exposure that did not occur or was not

expected to occur.

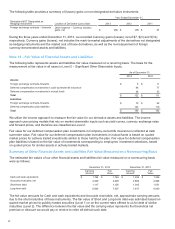

As of December 31, 2013, net after-tax losses of $37 were recorded in accumulated other comprehensive loss

associated with our cash flow hedging activity. The entire balance is expected to be reclassified into net income

within the next 12 months, providing an offsetting economic impact against the underlying anticipated transactions.

Non-Designated Derivative Instruments (Losses) Gains: Non-designated derivative instruments are primarily

instruments used to hedge foreign currency-denominated assets and liabilities. They are not designated as hedges

since there is a natural offset for the re-measurement of the underlying foreign currency-denominated asset or

liability.

Xerox 2013 Annual Report 98