Xerox 2013 Annual Report Download - page 96

Download and view the complete annual report

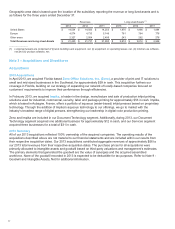

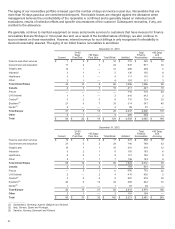

Please find page 96 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In July 2011, we acquired Education Sales and Marketing, LLC (ESM), a leading provider of outsourced

enrollment management and student loan default solutions, for approximately $43 net of cash acquired. The

acquisition of ESM enables us to offer a broader range of services to assist post-secondary schools in attracting

and retaining the most qualified students while reducing accreditation risk.

In April 2011, we acquired Unamic/HCN B.V., the largest privately-owned customer care provider in the Benelux

region in Western Europe, for approximately $55 net of cash acquired. Unamic/HCN’s focus on the Dutch-speaking

market expands our customer care capabilities in the Netherlands, Belgium, Turkey and Suriname.

In February 2011, we acquired Concept Group, Ltd. for $41 net of cash acquired. This acquisition expands our

reach into the small and mid-size business market in the U.K. Concept Group has nine locations throughout the

U.K. and provides document imaging solutions and technical services to more than 3,000 customers.

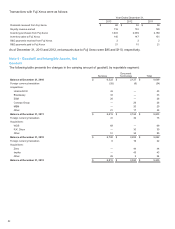

Our Document Technology segment also acquired three additional business in 2012 and seven additional business

in 2011 for $62 and $21, respectively, in cash. These acquisitions were largely a part of our strategy of increasing

our distribution network for small and mid-size businesses. Our Services segment acquired four additional

businesses in 2012 and three additional business in 2011 for $61 and $25, respectively, in cash primarily related to

customer care and software to support our BPO service offerings.

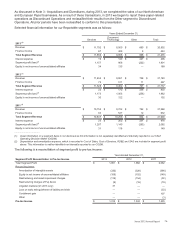

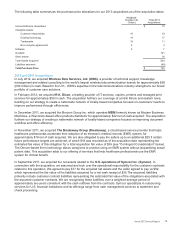

Summary - 2012 and 2011 Acquisitions

All of our 2012 and 2011 acquisitions reflected 100% ownership of the acquired companies. The operating results of

the 2012 and 2011 acquisitions described above were not material to our financial statements and were included

within our results from the respective acquisition dates. WDS, Breakaway, Symcor, ESM and Unamic/HCN were

included within our Services segment while the acquisitions of R.K. Dixon, MBM and Concept Group were included

within our Document Technology segment. The purchase prices for all acquisitions, except Symcor, were primarily

allocated to intangible assets and goodwill based on third-party valuations and management's estimates. Refer to

Note 9 - Goodwill and Intangible Assets, Net for additional information. Our 2012 acquisitions contributed aggregate

revenues from their respective acquisition dates of approximately $277 and $162 to our 2013 and 2012 total

revenues, respectively. Our 2011 acquisitions contributed aggregate revenues from their respective acquisition

dates of approximately $396, $397 and $177 to our 2013, 2012 and 2011 total revenues, respectively.

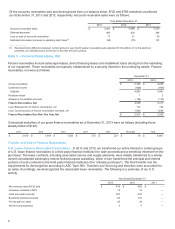

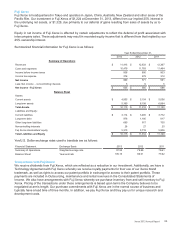

Contingent Consideration

In connection with certain acquisitions, we are obligated to make contingent payments if specified contractual

performance targets are achieved. Contingent consideration obligations are recorded at their respective fair value.

As of December 31, 2013, the maximum aggregate amount of outstanding contingent obligations to former owners

of acquired entities was approximately $60, of which $36 was accrued representing the estimated fair value of this

obligation.

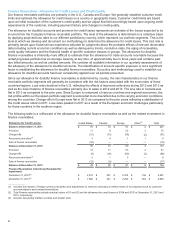

Divestitures

During 2013, in connection with our decision to exit from the Paper distribution business, we completed the sale of

our N.A. Paper business and our European Paper business. The decision to exit from the Paper distribution

business was largely the result of management's objective to focus more on Services and innovative Document

Technology. Net proceeds from the sale of the N.A. and European Paper businesses were approximately $36, of

which $26 was received in cash and is reported as cash flows from investing activities in the Consolidated

Statements of Cash Flows. The remainder of the proceeds of $10 were received as a note receivable, which is

payable in October 2014.

As a result of these transactions, in 2013 we reported these paper-related operations as Discontinued Operations

and reclassified their results from the Other segment to Discontinued Operations. All prior periods have accordingly

been reclassified to conform to this presentation. The net assets sold or expected to be sold in connection with

these transactions are primarily related to working capital - accounts receivables and inventory - utilized in the

business.

We recorded a net pre-tax loss of $25 for the disposition of our N.A. and European Paper businesses. The loss is

primarily related to exit and disposal costs associated with these businesses. The disposals resulted in a reduction

in headcount of approximately 300 employees, primarily in Europe.

79