Xerox 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

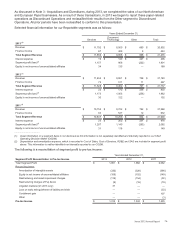

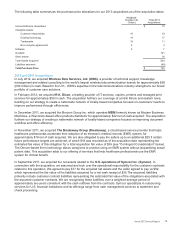

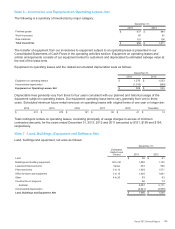

Geographic area data is based upon the location of the subsidiary reporting the revenue or long-lived assets and is

as follows for the three years ended December 31:

Revenues Long-Lived Assets (1)

2013 2012 2011 2013 2012 2011

United States $ 14,534 $ 14,500 $14,253 $1,870 $1,966 $1,894

Europe 4,574 4,733 5,148 761 784 776

Other areas 2,327 2,504 2,499 243 262 276

Total Revenues and Long-Lived Assets $ 21,435 $ 21,737 $21,900 $2,874 $3,012 $2,946

________________

(1) Long-lived assets are comprised of (i) land, buildings and equipment, net, (ii) equipment on operating leases, net, (iii) internal use software,

net and (iv) product software, net.

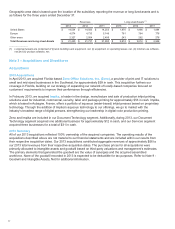

Note 3 – Acquisitions and Divestitures

Acquisitions

2013 Acquisitions

In April 2013, we acquired Florida based Zeno Office Solutions, Inc. (Zeno), a provider of print and IT solutions to

small and mid-sized businesses in the Southeast, for approximately $59 in cash. This acquisition furthers our

coverage in Florida, building on our strategy of expanding our network of locally-based companies focused on

customers' requirements to improve their performance through efficiencies.

In February 2013, we acquired Impika, a leader in the design, manufacture and sale of production inkjet printing

solutions used for industrial, commercial, security, label and package printing for approximately $53 in cash. Impika,

which is based in Aubagne, France, offers a portfolio of aqueous (water-based) inkjet presses based on proprietary

technology. Through the addition of Impika's aqueous technology to our offerings, we go to market with the

industry's broadest range of digital presses, strengthening our leadership in digital color production printing.

Zeno and Impika are included in our Document Technology segment. Additionally, during 2013, our Document

Technology segment acquired one additional business for approximately $12 in cash, and our Services segment

acquired three businesses for a total of $31 in cash.

2013 Summary

All of our 2013 acquisitions reflected 100% ownership of the acquired companies. The operating results of the

acquisitions described above are not material to our financial statements and are included within our results from

their respective acquisition dates. Our 2013 acquisitions contributed aggregate revenues of approximately $56 to

our 2013 total revenues from their respective acquisition dates. The purchase prices for all acquisitions were

primarily allocated to intangible assets and goodwill based on third-party valuations and management's estimates.

The primary elements that generated the goodwill are the value of synergies and the acquired assembled

workforce. None of the goodwill recorded in 2013 is expected to be deductible for tax purposes. Refer to Note 9 -

Goodwill and Intangible Assets, Net for additional information.

77