Xerox 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We have elected to apply settlement accounting and, therefore, we recognize the losses associated with these

settlements immediately upon the settlement of the vested benefits. Settlement accounting requires us to recognize

a pro rata portion of the aggregate unamortized net actuarial losses upon settlement. As noted above, cumulative

unamortized net actuarial losses were $2.4 billion at December 31, 2013, of which the U.S. primary domestic plans

represented approximately $600 million. The pro rata factor is computed as the percentage reduction in the

projected benefit obligation due to the settlement of a participant's vested benefit. Settlement accounting is only

applied when the event of settlement occurs - i.e. the lump-sum payment is made. Since settlement is dependent

on an employee's decision and election, the level of settlements and the associated losses can fluctuate

significantly period to period. In 2013, settlement losses associated with our primary domestic pension plans

amounted to $162 million and were $48 million, $31 million, $20 million and $63 million for the first through fourth

quarters of 2013, respectively. Currently, on average, approximately $100 million of plan settlements will result in

settlement losses of approximately $25 million. During the three years ended December 31, 2013, U.S. plan

settlements were $838 million, $481 million and $598 million, respectively.

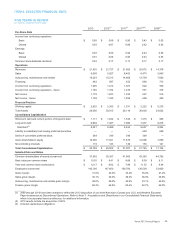

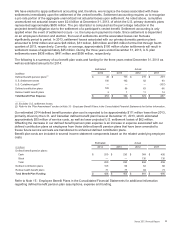

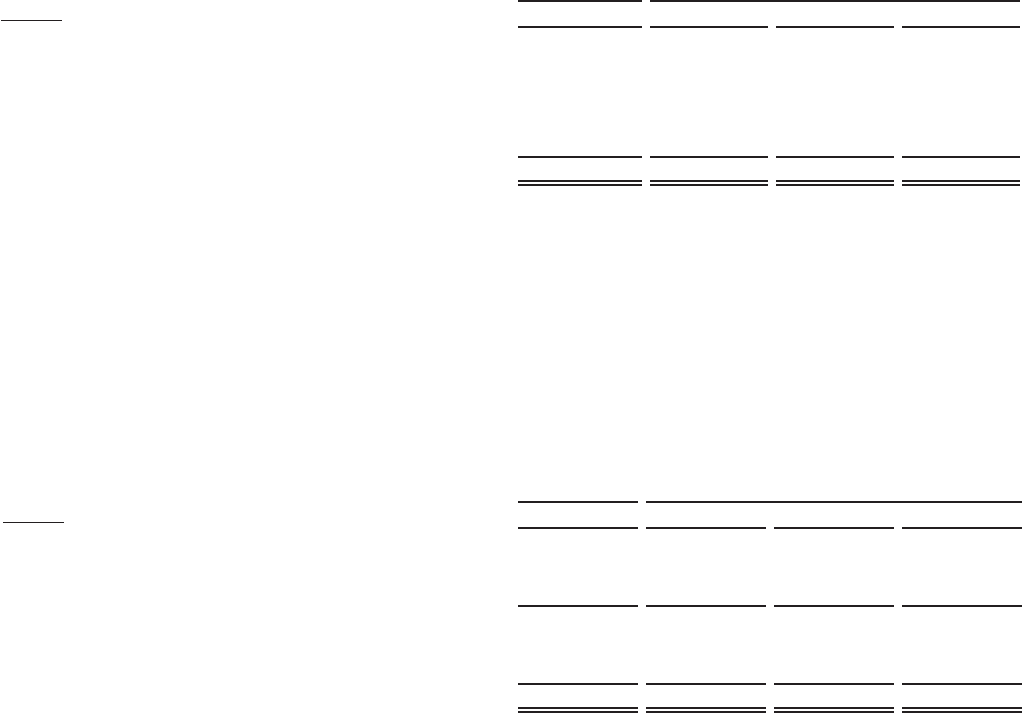

The following is a summary of our benefit plan costs and funding for the three years ended December 31, 2013 as

well as estimated amounts for 2014:

Estimated Actual

(in millions) 2014 2013 2012 2011

Defined benefit pension plans(1) $ 45 $ 105 $218 $204

U.S. Settlement losses 100 162 82 80

U.S. Curtailment gain(2) ———(107)

Defined contribution plans 105 96 63 66

Retiree health benefit plans 3 1 11 14

Total Benefit Plan Expense $253 $364 $374 $257

___________

(1) Excludes U.S. settlement losses.

(2) Refer to the "Plan Amendment" section in Note 15 - Employee Benefit Plans in the Consolidated Financial Statements for further information.

Our estimated 2014 defined benefit pension plan cost is expected to be approximately $111 million lower than 2013,

primarily driven by the U.K. and Canadian defined benefit plan freeze at December 31, 2013, which eliminated

approximately $55 million of service costs, as well as lower projected U.S. settlement losses of $62 million.

Offsetting the decrease in our defined benefit pension plan expense is an increase in expense associated with our

defined contribution plans as employees from those defined benefit pension plans that have been amended to

freeze future service accruals are transitioned to enhanced defined contribution plans.

Benefit plan costs are included in several income statement components based on the related underlying employee

costs.

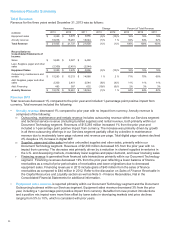

Estimated Actual

(in millions) 2014 2013 2012 2011

Defined benefit pension plans:

Cash $ 250 $230 $364 $426

Stock — — 130 130

Total 250 230 494 556

Defined contribution plans 105 96 63 66

Retiree health benefit plans 71 77 84 73

Total Benefit Plan Funding $426 $403 $641 $695

Refer to Note 15 - Employee Benefit Plans in the Consolidated Financial Statements for additional information

regarding defined benefit pension plan assumptions, expense and funding.

Xerox 2013 Annual Report 32