Xerox 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We do not anticipate that the adoption of this standard will have a material impact on our financial condition or

results of operations.

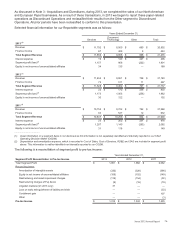

Presentation of Comprehensive Income

In February 2013, the FASB issued ASU No. 2013-02, Comprehensive Income (Topic 220) - Reporting of Amounts

Reclassified Out of Accumulated Other Comprehensive Income, which requires an entity to provide additional

information about the amounts reclassified out of Accumulated Other Comprehensive Income by component. This

update was effective for us beginning January 1, 2013 and the additional information required by this ASU is

reported in Note 20 - Other Comprehensive Income, including amounts related to 2012 and 2011.

Balance Sheet Offsetting

In December 2011, the FASB issued ASU 2011-11, Balance Sheet (Topic 210), Disclosures about Offsetting Assets

and Liabilities. ASU 2011-11 requires entities to disclose both gross information and net information about both

instruments and transactions eligible for offset in the Balance Sheet and instruments and transactions subject to an

agreement similar to a master netting arrangement to enable users of its financial statements to understand the

effects of offsetting and related arrangements on its financial position. In January 2013, the FASB issued ASU

2013-01, which limited the scope of this guidance to derivatives, repurchase type agreements and securities

borrowing and lending transactions. The guidance from these updates was effective for our fiscal year beginning

January 1, 2013. We currently report our derivative assets and liabilities on a gross basis in the Balance Sheet and

none of our derivative instruments are subject to a master netting agreement. Accordingly, no additional disclosures

were required upon adoption of these ASU's.

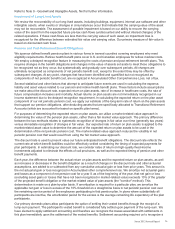

Fair Value Accounting

In May 2011, the FASB issued ASU 2011-04, which amended Fair Value Measurements and Disclosures - Overall

(ASC Topic 820-10) to provide a consistent definition of fair value and ensure that the fair value measurement and

disclosure requirements are similar between U.S. GAAP and International Financial Reporting Standards. This

update changed certain fair value measurement principles and enhanced the disclosure requirements, particularly

for level 3 fair value measurements. We adopted this update prospectively effective for our fiscal year beginning

January 1, 2012. This update did not have a material effect on financial condition or results of operations.

Summary of Accounting Policies

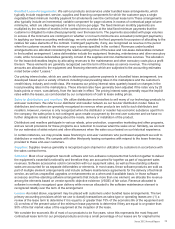

Revenue Recognition

We generate revenue through services, the sale and rental of equipment, supplies and income associated with the

financing of our equipment sales. Revenue is recognized when it is realized or realizable and earned. We consider

revenue realized or realizable and earned when we have persuasive evidence of an arrangement, delivery has

occurred, the sales price is fixed or determinable and collectibility is reasonably assured. Delivery does not occur

until equipment has been shipped or services have been provided to the customer, risk of loss has transferred to

the customer, and either customer acceptance has been obtained, customer acceptance provisions have lapsed, or

the company has objective evidence that the criteria specified in the customer acceptance provisions have been

satisfied. The sales price is not considered to be fixed or determinable until all contingencies related to the sale

have been resolved. More specifically, revenue related to services and sales of our products is recognized as

follows:

Equipment-Related Revenues

Equipment: Revenues from the sale of equipment, including those from sales-type leases, are recognized at the

time of sale or at the inception of the lease, as appropriate. For equipment sales that require us to install the product

at the customer location, revenue is recognized when the equipment has been delivered and installed at the

customer location. Sales of customer installable products are recognized upon shipment or receipt by the customer

according to the customer's shipping terms. Revenues from equipment under other leases and similar

arrangements are accounted for by the operating lease method and are recognized as earned over the lease term,

which is generally on a straight-line basis.

Technical Services: Technical service revenues are derived primarily from maintenance contracts on the

equipment sold to our customers and are recognized over the term of the contracts. A substantial portion of our

products are sold with full service maintenance agreements for which the customer typically pays a base service fee

plus a variable amount based on usage. As a consequence, other than the product warranty obligations associated

with certain of our low end products, we do not have any significant product warranty obligations, including any

obligations under customer satisfaction programs.

69