Xerox 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

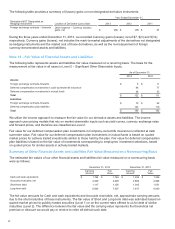

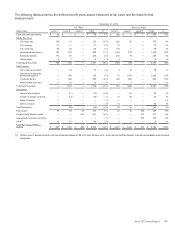

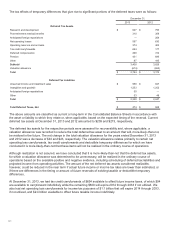

December 31, 2012

U.S. Plans Non-U.S. Plans

Asset Class Level 1 Level 2 Level 3 Total % Level 1 Level 2 Level 3 Total %

Cash and cash equivalents $ 48 $ — $ — $ 48 1% $ 500 $ — $ — $ 500 9%

Equity Securities:

U.S. large cap 411 10 — 421 12% 204 50 — 254 5%

Xerox common stock 99 — — 99 3% — — — — —%

U.S. mid cap 79 — — 79 2% 14 — — 14 —%

U.S. small cap 67 28 — 95 3% 30 1 — 31 1%

International developed 133 205 — 338 9% 1,107 174 — 1,281 24%

Emerging markets 282 67 — 349 10% 322 76 — 398 7%

Global equity 2 6 — 8 —% 5 12 — 17 —%

Total Equity Securities 1,073 316 — 1,389 39% 1,682 313 — 1,995 37%

Fixed Income:

U.S. treasury securities — 367 — 367 10% 1 19 — 20 —%

Debt security issued by

government agency — 153 — 153 4% 35 1,253 — 1,288 24%

Corporate bonds — 1,080 — 1,080 31% 150 753 — 903 17%

Asset backed securities — 11 — 11 —% 3 31 — 34 1%

Total Debt Securities — 1,611 — 1,611 45% 189 2,056 — 2,245 42%

Common/Collective trust — — — — —% 2 — — 2 —%

Derivatives:

Interest rate contracts — 15 — 15 —% — 74 — 74 1%

Foreign exchange contracts (2) — — (2) —% 9 8 — 17 —%

Equity contracts 5 — — 5 —% — — — — —%

Credit contracts — (1) — (1) —% — — — — —%

Other contracts — — — — —% 69 — — 69 1%

Total Derivatives 3 14 — 17 —% 78 82 — 160 2%

Hedge funds — — — — —% — — 3 3 —%

Real estate 59 46 58 163 5% 19 35 332 386 7%

Private equity/Venture capital — — 300 300 8% — — — — —%

Guaranteed insurance contracts — — — — —% — — 131 131 3%

Other(1) 12 33 — 45 2% 13 (4) — 9 —%

Total Fair Value Of Plans

Assets $ 1,195 $ 2,020 $ 358 $ 3,573 100% $ 2,483 $ 2,482 $ 466 $ 5,431 100%

_____________________________

(1) Other Level 1 assets include net non-financial liabilities of $13 U.S. and $5 Non-U.S., such as due to/from broker, interest receivables and

accrued expenses.

105