Xerox 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

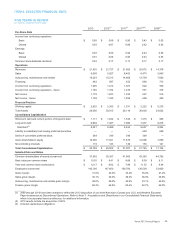

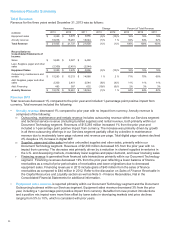

Revenue 2012 Total revenues decreased 1% compared to the prior year and included a 1-percentage point

negative impact from currency. Total revenues included the following:

• Annuity revenue increased 1% and included a 1-percentage point negative impact from currency. Annuity

revenue is comprised of the following:

Outsourcing, maintenance and rentals revenue include outsourcing revenue within our Services segment

and technical service revenue (including bundled supplies) and rental revenue, both primarily within our

Document Technology segment. Revenues of $15,213 million increased 2% and included a 2-percentage

point negative impact from currency. The increase was primarily driven by growth in all three outsourcing

offerings in our Services segment partially offset by a decline in technical service revenues. Total digital

pages declined 2% despite a 3% increase in digital MIF.

Supplies, paper and other sales include unbundled supplies and other sales, primarily within our Document

Technology segment. Revenues of $2,451 million decreased 4% and included a 1-percentage negative

impact from currency. The decrease was primarily due to moderately lower demand.

Financing revenue is generated from financed sale transactions primarily within our Document Technology

segment. The decrease of 6% from 2011 reflects a lower balance of finance receivables primarily from

lower originations due to decreased equipment sales. The decrease was partially offset by $44 million in

gains from the sale of finance receivables from our Document Technology segment. Refer to the

discussion on Sales of Finance Receivable in the Capital Resources and Liquidity section as well as to

Note 5 - Finance Receivables, Net in the Consolidated Financial Statements for additional information.

• Equipment sales revenue is reported primarily within our Document Technology segment and the document

outsourcing business within our Services segment. Equipment sales revenue decreased 10% and included a

2-percentage point negative impact from currency primarily driven by delayed customer decision-making and

overall weak economic and market conditions. An increase in total product installs was offset by the impact of

lower product mix and price declines. Price declines were in the range of 5% to 10%.

An analysis of the change in revenue for each business segment is included in the “Operations Review of Segment

Revenue and Profit” section.

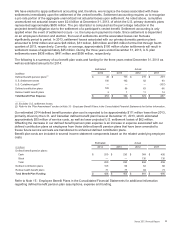

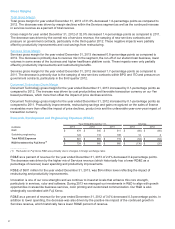

Costs, Expenses and Other Income

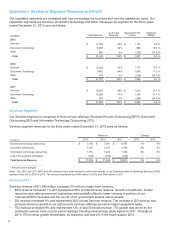

Summary of Key Financial Ratios

Year Ended December 31, Change

2013 2012 2011 2013 2012

Total Gross Margin 31.0%32.0%33.4%(1.0) pts (1.4) pts

RD&E as a % of Revenue 2.8% 3.0% 3.3% (0.2) pts (0.3) pts

SAG as a % of Revenue 19.3%19.4%20.2%(0.1) pts (0.8) pts

Operating Margin(1) 8.9% 9.5% 10.0%(0.6) pts (0.5) pts

Pre-tax Income Margin 6.1% 6.1% 7.0% — pts (0.9) pts

Operating Margin

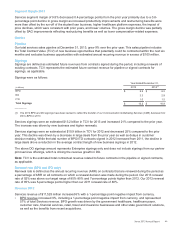

The operating margin1 for the year ended December 31, 2013 of 8.9% decreased 0.6-percentage points as

compared to 2012. The decline was driven primarily by a decline in gross margin of 1.0-percentage points partially

offset by a moderate improvement in operating expenses as a percent of revenue. The operating margin decline

reflects continued pressure on Services margins from higher healthcare platform expenses and the run-off of the

student loan business, as well as from higher pension settlement costs impacting Document Technology.

The operating margin1 for the year ended December 31, 2012 of 9.5% decreased 0.5-percentage points as

compared to 2011. The decline, which was primarily in our Services segment due to a decrease in gross margin,

was partially offset by expense reductions.

_____________

(1) See the "Non-GAAP Financial Measures" section for an explanation of the Operating Margin non-GAAP financial measure.

Xerox 2013 Annual Report 36