Xerox 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

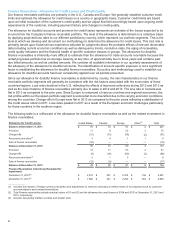

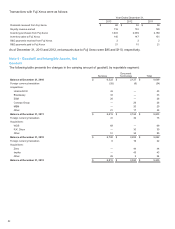

The aging of our receivables portfolio is based upon the number of days an invoice is past due. Receivables that are

more than 90 days past due are considered delinquent. Receivable losses are charged against the allowance when

management believes the uncollectibility of the receivable is confirmed and is generally based on individual credit

evaluations, results of collection efforts and specific circumstances of the customer. Subsequent recoveries, if any, are

credited to the allowance.

We generally continue to maintain equipment on lease and provide services to customers that have invoices for finance

receivables that are 90 days or more past due and, as a result of the bundled nature of billings, we also continue to

accrue interest on those receivables. However, interest revenue for such billings is only recognized if collectability is

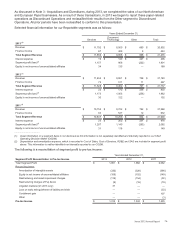

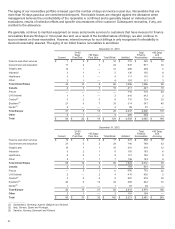

deemed reasonably assured. The aging of our billed finance receivables is as follows:

December 31, 2013

Current

31-90

Days

Past Due

>90 Days

Past Due Total Billed Unbilled

Total

Finance

Receivables

>90 Days

and

Accruing

Finance and other services $ 7 $ 2$ 1 $ 10 $ 315 $325 $ 12

Government and education 17 43 24 647 671 34

Graphic arts 12 1— 13 296 309 5

Industrial 311 5 130 135 6

Healthcare 31— 4 111 115 5

Other 31— 4 107 111 3

Total United States 45 10 5 60 1,606 1,666 65

Canada 433 10 411 421 19

France ————718 718 40

U.K./Ireland 11— 2 410 412 2

Central(1) 323 8 716 724 23

Southern(2) 21 57 33 314 347 45

Nordic(3) 2 — — 2 89 91 —

Total Europe 27 810 45 2,247 2,292 110

Other 81— 9 295 304 —

Total $ 84 $ 22 $ 18 $ 124 $4,559 $4,683 $194

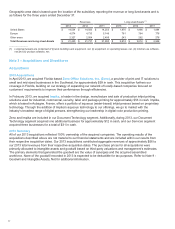

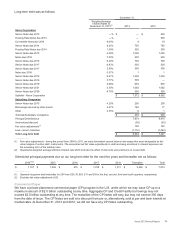

December 31, 2012

Current

31-90

Days

Past Due

>90 Days

Past Due Total Billed Unbilled

Total

Finance

Receivables

>90 Days

and

Accruing

Finance and other services $ 12 $ 3$ 2 $ 17 $ 441 $458 $ 18

Government and education 21 53 29 740 769 42

Graphic arts 16 11 18 301 319 12

Industrial 5 21 8 155 163 6

Healthcare 6 21 9 151 160 9

Other 5 11 7 136 143 6

Total United States 65 14 9 88 1,924 2,012 93

Canada 232 7 794 801 30

France — 51 6 696 702 22

U.K./Ireland 2 — 2 4 416 420 2

Central(1) 324 9 807 816 30

Southern(2) 20 814 42 400 442 72

Nordic(3) 1 — — 1 93 94 —

Total Europe 26 15 21 62 2,412 2,474 126

Other 21— 3 191 194 —

Total $ 95 $ 33 $ 32 $ 160 $5,321 $5,481 $249

________________

(1) Switzerland, Germany, Austria, Belgium and Holland.

(2) Italy, Greece, Spain and Portugal.

(3) Sweden, Norway, Denmark and Finland.

85