Xerox 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

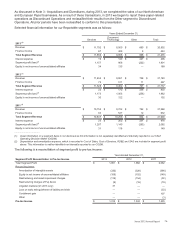

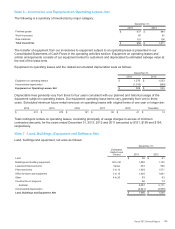

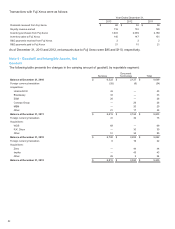

Note 6 – Inventories and Equipment on Operating Leases, Net

The following is a summary of Inventories by major category:

December 31,

2013 2012

Finished goods $837 $844

Work-in-process 60 61

Raw materials 101 106

Total Inventories $998 $1,011

The transfer of equipment from our inventories to equipment subject to an operating lease is presented in our

Consolidated Statements of Cash Flows in the operating activities section. Equipment on operating leases and

similar arrangements consists of our equipment rented to customers and depreciated to estimated salvage value at

the end of the lease term.

Equipment on operating leases and the related accumulated depreciation were as follows:

December 31,

2013 2012

Equipment on operating leases $ 1,575 $1,533

Accumulated depreciation (1,016) (998)

Equipment on Operating Leases, Net $559 $535

Depreciable lives generally vary from three to four years consistent with our planned and historical usage of the

equipment subject to operating leases. Our equipment operating lease terms vary, generally from one to three

years. Scheduled minimum future rental revenues on operating leases with original terms of one year or longer are:

2014 2015 2016 2017 2018 Thereafter

$ 331 $ 275 $ 181 $ 95 $ 41 $ 14

Total contingent rentals on operating leases, consisting principally of usage charges in excess of minimum

contracted amounts, for the years ended December 31, 2013, 2012 and 2011 amounted to $151, $158 and $154,

respectively.

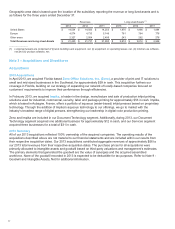

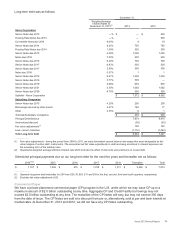

Note 7 - Land, Buildings, Equipment and Software, Net

Land, buildings and equipment, net were as follows:

December 31,

Estimated

Useful Lives

(Years) 2013 2012

Land $ 50 $ 61

Buildings and building equipment 25 to 50 1,086 1,135

Leasehold improvements Varies 483 506

Plant machinery 5 to 12 1,493 1,571

Office furniture and equipment 3 to 15 1,826 1,681

Other 4 to 20 83 83

Construction in progress 66 74

Subtotal 5,087 5,111

Accumulated depreciation (3,621)(3,555)

Land, Buildings and Equipment, Net $ 1,466 $1,556

Xerox 2013 Annual Report 86