Xerox 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

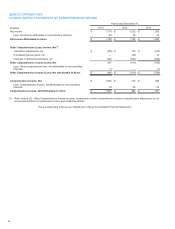

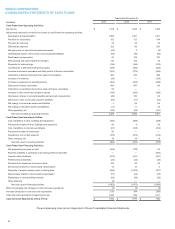

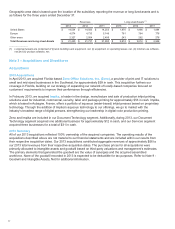

The following table summarizes certain significant costs and expenses that require management estimates for the

three years ended December 31, 2013:

Year Ended December 31,

Expense/(Income) 2013 2012 2011

Provisions for restructuring and asset impairments $ 116 $154 $ 32

Provisions for receivables 123 127 154

Provisions for litigation and regulatory matters (34) (1) 11

Provisions for obsolete and excess inventory 35 30 39

Provisions for product warranty liability 28 29 30

Depreciation and obsolescence of equipment on operating leases 283 279 294

Depreciation of buildings and equipment 431 452 405

Amortization of internal use software 147 116 91

Amortization of product software 43 19 11

Amortization of acquired intangible assets 332 328 401

Amortization of customer contract costs 122 107 49

Defined pension benefits - net periodic benefit cost(1) 267 300 177

Retiree health benefits - net periodic benefit cost 1 11 14

Income tax expense 276 272 377

______________

(1) 2011 includes $107 pre-tax curtailment gain - refer to Note 15 - Employee Benefit Plans for additional information.

Changes in Estimates

In the ordinary course of accounting for the items discussed above, we make changes in estimates as appropriate

and as we become aware of new or revised circumstances surrounding those estimates. Such changes and

refinements in estimation methodologies are reflected in reported results of operations in the period in which the

changes are made and, if material, their effects are disclosed in the Notes to the Consolidated Financial Statements

and in Management's Discussion and Analysis of Financial Condition and Results of Operations.

New Accounting Standards and Accounting Changes

Except for the Accounting Standard Updates (ASU's) discussed below, the new ASU's issued by the FASB during

the last two years did not have any significant impact on the Company.

Income Taxes

In July 2013, the FASB issued ASU 2013-11, Presentation of Unrecognized Tax Benefit When a Net Operating Loss

Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists. This update provides guidance on the

financial statement presentation of unrecognized tax benefits when a net operating loss carryforward, a similar tax

loss, or a tax credit carryforward, exists. The guidance from this update is effective prospectively for our fiscal year

beginning January 1, 2014. Upon adoption of this standard, we expect to reclassify approximately $200 of liabilities

for unrecognized tax benefits against deferred tax assets.

Hedge Accounting

In July 2013, the FASB issued ASU 2013-10, Inclusion of the Fed Funds Effective Swap Rate (or Overnight Index

Swap Rate) as a Benchmark Interest Rate for Hedge Accounting Purposes. The update permits the Fed Funds

Effective Swap Rate to be used as a U.S. benchmark interest rate for hedge accounting purposes under FASB ASC

Topic 815, in addition to the interest rates on direct Treasury obligations of the U.S. government (UST) and the

London Interbank Offered Rate (LIBOR). The update also removes the restriction on using different benchmark

rates for similar hedges. ASU 2013-10 is effective prospectively for qualifying new or re-designated hedging

relationships entered into on or after July 17, 2013. The adoption of this standard did not have a material impact on

our financial condition or results of operations.

Cumulative Translation Adjustments

In March 2013, the FASB issued ASU 2013-05, Parent's Accounting for the Cumulative Translation Adjustment

upon Derecognition of Certain Subsidiaries or Groups of Assets within a Foreign Entity or of an Investment in a

Foreign Entity. The objective of ASU 2013-05 is to resolve the diversity in practice regarding the release into net

income of the cumulative translation adjustment upon derecognition of a subsidiary or group of assets within a

foreign entity. The guidance from this update is effective prospectively for our fiscal year beginning January 1, 2014.

Xerox 2013 Annual Report 68