Xerox 2013 Annual Report Download - page 73

Download and view the complete annual report

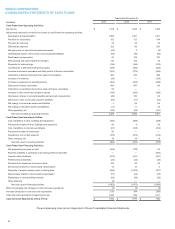

Please find page 73 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Refer to Note 16 - Income and Other Taxes in the Consolidated Financial Statements for additional information

regarding unrecognized tax benefits.

Off-Balance Sheet Arrangements

We may occasionally utilize off-balance sheet arrangements in our operations (as defined by the SEC Financial

Reporting Release 67 (FRR-67), “Disclosure in Management’s Discussion and Analysis about Off-Balance Sheet

Arrangements and Aggregate Contractual Obligations”). We enter into the following arrangements that have off-

balance sheet elements:

• Operating leases in the normal course of business. The nature of these lease arrangements is discussed in

Note 7 - Land, Buildings, Equipment and Software, Net in the Consolidated Financial Statements.

• We have facilities, primarily in the U.S., Canada and several countries in Europe that enable us to sell to third-

parties certain accounts receivable without recourse. In most instances, a portion of the sales proceeds are held

back by the purchaser and payment is deferred until collection of the related sold receivables. Refer to Note 4 -

Accounts Receivables, Net in the Consolidated Financial Statements for further information regarding these

facilities.

• During 2013 and 2012, we entered into arrangements to transfer and sell our entire interest in certain groups of

finance receivables where we received cash and beneficial interests from the third-party purchaser. Refer to

Note 5 - Finance Receivables, Net in the Consolidated Financial Statements for further information regarding

these sales.

At December 31, 2013, we do not believe we have any off-balance sheet arrangements that have, or are

reasonably likely to have, a material current or future effect on financial condition, changes in financial condition,

revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

In addition, see the table above for the Company's contractual cash obligations and other commercial commitments

and Note 17 - Contingencies and Litigation in the Consolidated Financial Statements for additional information

regarding contingencies, guarantees, indemnifications and warranty liabilities.

Non-GAAP Financial Measures

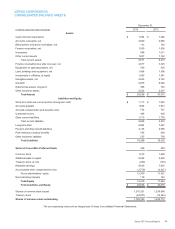

We have reported our financial results in accordance with generally accepted accounting principles (GAAP). In

addition, we have discussed our results using non-GAAP measures.

Management believes that these non-GAAP financial measures provide an additional means of analyzing the

current periods’ results against the corresponding prior periods’ results. However, these non-GAAP financial

measures should be viewed in addition to, and not as a substitute for, the Company’s reported results prepared in

accordance with GAAP. Our non-GAAP financial measures are not meant to be considered in isolation or as a

substitute for comparable GAAP measures and should be read only in conjunction with our consolidated financial

statements prepared in accordance with GAAP. Our management regularly uses our supplemental non-GAAP

financial measures internally to understand, manage and evaluate our business and make operating decisions.

These non-GAAP measures are among the primary factors management uses in planning for and forecasting future

periods. Compensation of our executives is based in part on the performance of our business based on these non-

GAAP measures.

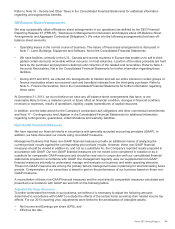

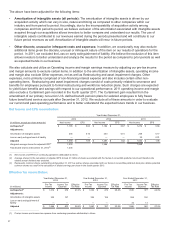

A reconciliation of these non-GAAP financial measures and the most directly comparable measures calculated and

presented in accordance with GAAP are set forth on the following tables.

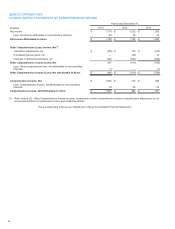

Adjusted Earnings Measures

To better understand the trends in our business, we believe it is necessary to adjust the following amounts

determined in accordance with GAAP to exclude the effects of the certain items as well as their related income tax

effects. For our 2013 reporting year, adjustments were limited to the amortization of intangible assets.

• Net income and Earnings per share (EPS), and

• Effective tax rate.

Xerox 2013 Annual Report 56