Xerox 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

The following Management’s Discussion and Analysis (MD&A) is intended to help the reader understand the results

of operations and financial condition of Xerox Corporation. MD&A is provided as a supplement to, and should be

read in conjunction with, our Consolidated Financial Statements and the accompanying notes. Throughout the

MD&A, we refer to various notes to our Consolidated Financial Statements which appear in Item 8 of this 2013

Form 10-K, and the information contained in such notes is incorporated by reference into the MD&A in the places

where such references are made.

Throughout this document, references to “we,” “our,” the “Company,” and “Xerox” refer to Xerox Corporation and its

subsidiaries. References to “Xerox Corporation” refer to the stand-alone parent company and do not include its

subsidiaries.

Executive Overview

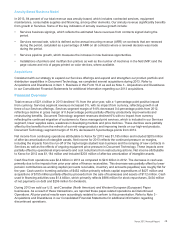

With revenues of $21.4 billion, we are the world's leading global enterprise for business process and document

management solutions. We provide services, technology and expertise to enable our customers - from small

businesses to large global enterprises - to focus on their core business and operate more effectively.

2013 marked the 75th anniversary of the first xerographic image, created by Chester Carlson to simplify the process

of copying information. This xerographic process is still at the heart of most office printers and copiers around the

world. From printers and multifunction devices, to business services and solutions for transportation, education, and

healthcare, the Company’s engineers, scientists and researchers are continuing to invent ways that make work, and

life, a little simpler.

We are a leader across large, diverse and growing markets estimated at over $600 billion. Headquartered in

Norwalk, Connecticut, the 143,100 people of Xerox serve customers in more than 160 countries providing business

services, printing equipment and software for commercial and government organizations. In 2013, 32 percent of our

revenue was generated outside the U.S.

We organize our business around two main segments: Services and Document Technology.

• Our Services segment is comprised of business process outsourcing (BPO), information technology

outsourcing (ITO) and document outsourcing (DO) services.

A key priority in 2013 was continued growth in our services business. Revenue from Services grew 3% in 2013,

reflecting growth from all three service offerings, BPO, ITO and DO, and represented 55% of our total revenues.

Growth was below our expectations primarily due to lower than expected contributions from acquisitions and the

effects of the run-off of our student loan business. In 2013, our Services signings grew as we continued to win in

the marketplace. In 2013, we introduced a new government healthcare Medicaid platform and supported the

launch of health insurance exchanges in several states. Across our services portfolio, the diversity of our

offerings and the differentiated solutions we provide, enable us to deliver greater value to our customers.

• Our Document Technology segment is comprised of our document technology and related supplies, technical

service and equipment financing (excluding contracts related to document outsourcing). Our product groups

within this segment include Entry, Mid-Range and High-End products.

In 2013 we focused on maintaining our leadership in Document Technology as well as improving our

productivity to reduce our cost base. This strategy included the introduction of new products like our

ConnectKey® enabled devices as well as steadily growing our channel operations to expand our reach to small

and mid-sized businesses (SMB). Although Document Technology revenues declined 6% in 2013, in line with

expectations, segment margin was 10.8%, at the high end of our targeted range of 9% to 11%.

27