Xerox 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

Xerox 2013 Annual Report

Non-GAAP Measures

was the

top-level

to be registered with the U.S.

Department of Defense

xerox.com

seventh

domain name

xerox.com

1st Xerox

group

(Bay Area Black Employees)

In 1969 the

caucus

San Francisco

started in

Every year Xerox manages

public transport

transactions

worldwide

across 400

cities

37 billion

Xerox

energy saving

in our equipment

first to introduce

power-down features

was the

Xerox received an

Emmy for

our pioneering

support of the first

electronic graphic

creative system

Xerox received an

Emmy for

our pioneering

support of the first

electronic graphic

creative system

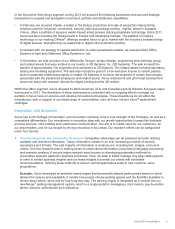

Adjusted Earnings Per Share (EPS) Year Ended December 31,

2013 2012 2011 2010 2009

(in millions; except per share amounts) Net Income EPS Net Income EPS Net Income Net Income Net Income

As Reported(1) $ 1,185 $ 0.93 $ 1,184 $ 0.87 $ 1,274 $ 591 $ 478

Adjustments:

Amortization of intangible assets 205 0.16 203 0.15 248 194 38

Loss on early extinguishment of debt – – – – 20 10 –

Xerox and Fuji Xerox restructuring charge – – – – – 355 41

ACS acquisition-related costs – – – – – 58 49

ACS shareholders’ litigation settlement – – – – – 36 –

Venezuela devaluation costs – – – – – 21 –

Medicare subsidy tax law change – – – – – 16 –

205 0.16 203 0.15 268 690 128

Adjusted $ 1,390 $ 1.09 $ 1,387 $ 1.02 $ 1,542 $ 1,281 $ 606

Weighted average shares for adjusted EPS(2) 1,274 1,356

(1)

Net income and EPS from continuing operations attributable to Xerox.

(2)

Average shares for the calculation of adjusted EPS include 27 million shares associated with the Series A convertible preferred stock and therefore the related

quarterly dividend was excluded.

Operating Margin (in millions) Year Ended December 31,

2013 2012 2011 2010 2009

Total Revenues(1) $ 21,435 $ 21,737 $ 21,900 $ 20,872 $ 14,376

Pre-tax Income(1) $ 1,312 $ 1,332 $ 1,535 $ 793 $ 616

Adjustments:

Amortization of intangible assets 332 328 398 312 60

Xerox restructuring charge 116 154 32 483 (8)

Curtailment gain – – (107) – –

ACS acquisition-related costs –– – 77 72

Other expenses, net 150 261 326 392 289

Adjusted Operating Income $ 1,910 $ 2,075 $ 2,184 $ 2,057 $ 1,029

Pre-tax Income Margin 6.1% 6.1% 7.0% 3.8% 4.3%

Adjusted Operating Margin 8.9% 9.5% 10.0% 9.9% 7.2%

(1) Revenue and Profit from continuing operations attributable to Xerox.

Constant Currency

To better understand trends in our business, we believe that it is helpful to adjust revenue to exclude the impact of changes in the translation of foreign currencies

into U.S. dollars. We refer to this adjusted revenue as “constant currency.” Currencies for developing market countries (Latin America, Brazil, Middle East, India,

Eurasia and Central-Eastern Europe) that we operate in are reported at actual exchange rates for both actual and constant revenue growth rates because (1) these

countries historically have had volatile currency and inflationary environments and (2) our subsidiaries in these countries have historically taken pricing actions to

mitigate the impact of inflation and devaluation. Management believes the constant currency measure provides investors an additional perspective on revenue

trends. Currency impact can be determined as the difference between actual growth rates and constant currency growth rates.

Note: 2009 through 2012 have been restated to reflect the 2013 disposition of our North American (Canada and U.S.) and Western European Paper business as

Discontinued Operations.