Xerox 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

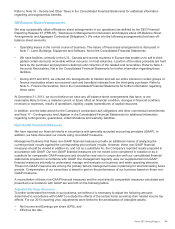

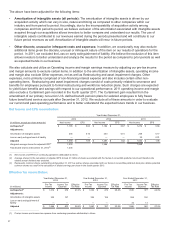

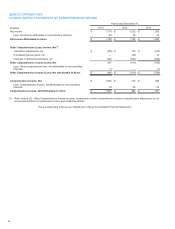

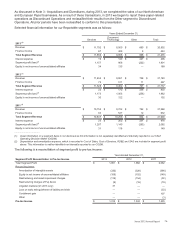

XEROX CORPORATION

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

(in millions)

Common

Stock

Additional

Paid-in

Capital

Treasury

Stock

Retained

Earnings AOCL(3)

Xerox

Shareholders’

Equity

Non-

controlling

Interests

Total

Equity

Balance at December 31, 2010 $ 1,398 $ 6,580 $ — $ 6,016 $ (1,988) $ 12,006 $ 153 $ 12,159

Comprehensive income, net — — — 1,295 (728) 567 32 599

Cash dividends declared-common stock(1) — — — (241) — (241) — (241)

Cash dividends declared-preferred stock(2) — — — (24) — (24) — (24)

Contribution of common stock to U.S. pension

plan 17 113 — — — 130 — 130

Stock option and incentive plans, net 11 128 — — — 139 — 139

Payments to acquire treasury stock, including

fees — — (701) — — (701) — (701)

Cancellation of treasury stock (73) (504) 577 — — — — —

Distributions to noncontrolling interests — — — — — — (36) (36)

Balance at December 31, 2011 $ 1,353 $ 6,317 $ (124) $ 7,046 $ (2,716) $ 11,876 $ 149 $ 12,025

Comprehensive income, net — — — 1,195 (511) 684 28 712

Cash dividends declared-common stock(1) — — — (226) — (226) — (226)

Cash dividends declared-preferred stock(2) — — — (24) — (24) — (24)

Contribution of common stock to U.S. pension

plan 15 115 — — — 130 — 130

Stock option and incentive plans, net 18 115 — — — 133 — 133

Payments to acquire treasury stock, including

fees — — (1,052) — — (1,052) — (1,052)

Cancellation of treasury stock (147) (925) 1,072 — — — — —

Distributions to noncontrolling interests — — — — — — (34) (34)

Balance at December 31, 2012 $ 1,239 $ 5,622 $ (104) $ 7,991 $ (3,227) $ 11,521 $ 143 $ 11,664

Comprehensive income, net — — — 1,159 448 1,607 19 1,626

Cash dividends declared-common stock(1) — — — (287) — (287) — (287)

Cash dividends declared-preferred stock(2) — — — (24) — (24) — (24)

Conversion of notes to common stock 1 8 — — — 9 — 9

Stock option and incentive plans, net 28 142 — — — 170 — 170

Payments to acquire treasury stock, including

fees — — (696) — — (696) — (696)

Cancellation of treasury stock (58) (490) 548 — — — — —

Distributions to noncontrolling interests — — — — — — (43) (43)

Balance at December 31, 2013 $ 1,210 $ 5,282 $ (252) $ 8,839 $ (2,779) $ 12,300 $ 119 $ 12,419

_______________

(1) Cash dividends declared on common stock of $0.0575 in each quarter of 2013 and $0.0425 in each quarter of 2012 and 2011.

(2) Cash dividends declared on preferred stock of $20 per share in each quarter of 2013, 2012 and 2011.

(3) AOCL - Accumulated other comprehensive loss.

The accompanying notes are an integral part of these Consolidated Financial Statements.

Xerox 2013 Annual Report 66