Xerox 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

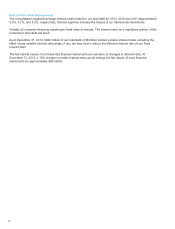

believe it is practical to calculate the potential tax impact, as there is a significant amount of uncertainty with respect

to determining the amount of foreign tax credits as well as any additional local withholding tax and other indirect tax

consequences that may arise from the distribution of these earnings. In addition, because such earnings have been

indefinitely reinvested in our foreign operations, repatriation would require liquidation of those investments or a

recapitalization of our foreign subsidiaries, the impacts and effects of which are not readily determinable.

Loan Covenants and Compliance

At December 31, 2013, we were in full compliance with the covenants and other provisions of our Credit Facility and

Senior Notes. We have the right to terminate the Credit Facility without penalty. Failure to comply with material

provisions or covenants of the Credit Facility and Senior Notes could have a material adverse effect on our liquidity

and operations and our ability to continue to fund our customers' purchase of Xerox equipment.

Refer to Note 12 - Debt in the Consolidated Financial Statements for additional information regarding debt

arrangements.

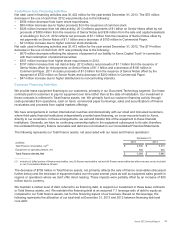

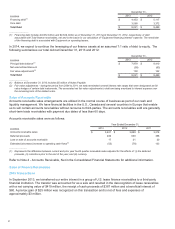

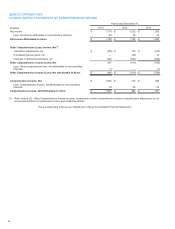

Contractual Cash Obligations and Other Commercial Commitments and Contingencies

At December 31, 2013, we had the following contractual cash obligations and other commercial commitments and

contingencies:

(in millions) 2014 2015 2016 2017 2018 Thereafter

Total debt, including capital lease obligations(1) $1,112 $1,283 $975 $1,018 $1,011 $2,580

Interest on debt(1) 376 307 248 191 146 647

Minimum operating lease commitments(2) 579 467 304 122 72 92

Defined benefit pension plans 250 — — — — —

Retiree health payments 71 73 71 70 69 317

Estimated Purchase Commitments:

Fuji Xerox(3) 1,903 —————

Flextronics(4) 499 — — — — —

Other(5) 169 113 151 70 64 117

Total $4,959 $2,243 $1,749 $1,471 $1,362 $3,753

_______________

(1) Total debt for 2014 includes $5 million of Notes Payable. Refer to Note 12 - Debt in the Consolidated Financial Statements for additional

information regarding debt. and interest on debt.

(2) Refer to Note 7 - Land, Buildings, Equipment and Software, Net in the Consolidated Financial Statements for additional information related

to minimum operating lease commitments.

(3) Fuji Xerox: The amount included in the table reflects our estimate of purchases over the next year and is not a contractual commitment.

(4) Flextronics: We outsource certain manufacturing activities to Flextronics. The amount included in the table reflects our estimate of

purchases over the next year and is not a contractual commitment. In the past two years, actual purchases from Flextronics averaged

approximately $550 million per year.

(5) Other purchase commitments: We enter into other purchase commitments with vendors in the ordinary course of business. Our policy with

respect to all purchase commitments is to record losses, if any, when they are probable and reasonably estimable. We currently do not

have, nor do we anticipate, material loss contracts.

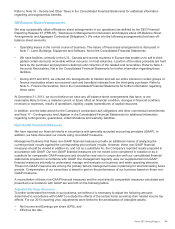

Pension and Other Post-retirement Benefit Plans

We sponsor defined benefit pension plans and retiree health plans that require periodic cash contributions. Our

2013 cash contributions for these plans were $230 million for our defined benefit pension plans and $77 million for

our retiree health plans. In 2014, based on current actuarial calculations, we expect to make contributions of

approximately $250 million to our worldwide defined benefit pension plans and approximately $71 million to our

retiree health benefit plans.

Contributions to our defined benefit pension plans in subsequent years will depend on a number of factors,

including the investment performance of plan assets and discount rates as well as potential legislative and plan

changes. At December 31, 2013, the un/under funded balance of our U.S. and Non-U.S. defined benefit pension

plans was $1,017 million and $875 million, respectively.

Our retiree health benefit plans are non-funded and are almost entirely related to domestic operations. Cash

contributions are made each year to cover medical claims costs incurred during the year. The amounts reported in

the above table as retiree health payments represent our estimate of future benefit payments.

Xerox 2013 Annual Report 54