Xerox 2013 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In general, we would only be liable for the amount of these guarantees in the event of default in our performance of

our obligations under each contract; the probability of which we believe is remote. We believe that our capacity in

the surety markets as well as under various credit arrangements (including our Credit Facility) is sufficient to allow

us to respond to future requests for proposals that require such credit support.

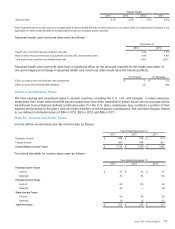

We have service arrangements where we service third-party student loans in the Federal Family Education Loan

program (FFEL) on behalf of various financial institutions. We service these loans for investors under outsourcing

arrangements and do not acquire any servicing rights that are transferable by us to a third-party. At December 31,

2013, we serviced a FFEL portfolio of approximately 3.2 million loans with an outstanding principal balance of

approximately $45.8 billion. Some servicing agreements contain provisions that, under certain circumstances,

require us to purchase the loans from the investor if the loan guaranty has been permanently terminated as a result

of a loan default caused by our servicing error. If defaults caused by us are cured during an initial period, any

obligation we may have to purchase these loans expires. Loans that we purchase may be subsequently cured, the

guaranty reinstated and the loans repackaged for sale to third parties. We evaluate our exposure under our

purchase obligations on defaulted loans and establish a reserve for potential losses, or default liability reserve,

through a charge to the provision for loss on defaulted loans purchased. The reserve is evaluated periodically and

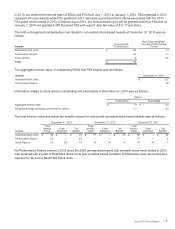

adjusted based upon management’s analysis of the historical performance of the defaulted loans. As of

December 31, 2013, other current liabilities include reserves which we believe to be adequate. At December 31,

2013, other current liabilities include reserves of approximately $3 for losses on defaulted loans purchased.

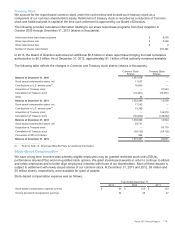

Note 18 - Preferred Stock

Series A Convertible Preferred Stock

We have issued 300,000 shares of Series A convertible perpetual preferred stock with an aggregate liquidation

preference of $300 and an initial fair value of $349. The convertible preferred stock pays quarterly cash dividends at

a rate of 8% per year ($24 per year). Each share of convertible preferred stock is convertible at any time, at the

option of the holder, into 89.8876 shares of common stock for a total of 26,966 thousand shares (reflecting an initial

conversion price of approximately $11.125 per share of common stock), subject to customary anti-dilution

adjustments.

On or after February 5, 2015, if the closing price of our common stock exceeds 130% of the then applicable

conversion price (currently $11.125 per share of common stock) for 20 out of 30 trading days, we have the right to

cause any or all of the convertible preferred stock to be converted into shares of common stock at the then

applicable conversion rate. The convertible preferred stock is also convertible, at the option of the holder, upon a

change in control, at the applicable conversion rate plus an additional number of shares determined by reference to

the price paid for our common stock upon such change in control. In addition, upon the occurrence of certain

fundamental change events, including a change in control or the delisting of Xerox's common stock, the holder of

convertible preferred stock has the right to require us to redeem any or all of the convertible preferred stock in cash

at a redemption price per share equal to the liquidation preference and any accrued and unpaid dividends to, but

not including the redemption date. The convertible preferred stock is classified as temporary equity (i.e., apart from

permanent equity) as a result of the contingent redemption feature.

Note 19 – Shareholders’ Equity

Preferred Stock

As of December 31, 2013, we had one class of preferred stock outstanding. See Note 18 - Preferred Stock for further

information. We are authorized to issue approximately 22 million shares of cumulative preferred stock, $1.00 par value

per share.

Common Stock

We have 1.75 billion authorized shares of common stock, $1.00 par value per share. At December 31, 2013, 127

million shares were reserved for issuance under our incentive compensation plans, 48 million shares were reserved for

debt to equity exchanges, 27 million shares were reserved for conversion of the Series A convertible preferred stock

and 1 million shares were reserved for the conversion of convertible debt.

115