Xerox 2013 Annual Report Download - page 20

Download and view the complete annual report

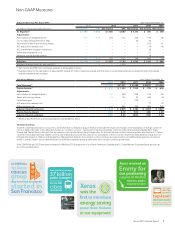

Please find page 20 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Profitability In-Line with the Industry Best

Margin expansion is a key priority and opportunity for Xerox that we will achieve through our continued focus on

operational excellence, as well as specific initiatives aimed at improving our cost structure and portfolio mix. Our

operational excellence model leverages our global delivery capabilities, production model, incentive-based

compensation process, proprietary systems and financial discipline to deliver productivity and lower costs for our

customers and for our business. As markets shift, we undertake restructuring to optimize our workforce and facilities

to best align our resources with the growth areas of our business, and to maximize profitability and cash flow in

businesses that are declining. In Services, we launched a major initiative to increase the percentage of our labor

spend in low-cost countries over the next several years. We also have initiatives underway to continue to improve

our software platform implementation and overall service delivery, which includes establishing strategic partnerships

to supplement our internal capabilities. With ongoing efforts and targeted initiatives, we look to maintain or increase

our competitive position with regard to profitability in each of our business areas.

Annuity-Based Business Model and Shareholder Centered Capital Allocation

Our business is based on an annuity model that provides significant recurring revenue and cash generation. In

2013, 84 percent of our total revenue was annuity-based; it includes contracted services, equipment maintenance,

consumable supplies and financing, among other elements. The remaining 16 percent of our revenue comes from

equipment sales, either from lease agreements that qualify as sales for accounting purposes or outright cash sales.

We remain committed to using our strong cash flow to deliver shareholder returns now and in the future through a

balanced capital allocation strategy that includes share repurchase, acquisitions and dividends.

Acquisitions and Divestitures

Consistent with our strategy to expand our Services offerings through acquisitions, we acquired the following

companies in 2013:

• In June, we acquired LearnSomething, Inc., a Florida-based provider of custom e-learning solutions and

consumer education for the food, drug and healthcare industries. This acquisition broadens the services Xerox

offers to these industries, providing retail companies with Web-based information programs that meet the

regulatory, operational, continuing education and internal training needs of their diverse and widely-distributed

workforces.

• In July, we acquired Customer Value Group Ltd (CVG), a London-based software company that specializes in

cloud-based accounts receivable and customer relationship management software. CVG’s primary product,

Value+, is a Software-as-a-Service (SaaS) cloud application that simplifies the management of customer credit,

collections and disputes; improving overall cash collections for our customers. With Value+, Xerox now offers a

flexible solution that can be tailored to meet any business model, further strengthening our full suite of finance

and accounting process services.

• In August, we acquired CPAS Systems, Inc., a Toronto-based company providing pension administration

software to the private and public sectors. CPAS software simplifies administration and record keeping for

defined benefit, defined contribution, and hybrid retirement savings plans and health, welfare and group life

insurance premiums. CPAS will be offered as both a standalone software solution and as part of our human

resources outsourcing services offering, with a special focus on the emerging market for government pension

administration outsourcing.

• In December, we announced the intent to acquire Germany-based Invoco Holding GmbH to expand our

European customer care services. The acquisition successfully closed in January 2014. Invoco provides our

global customers immediate access to industry-leading German-language customer care services and provides

Invoco’s existing customers access to our broad business process outsourcing capabilities.

3