Xerox 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

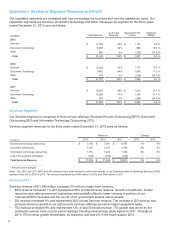

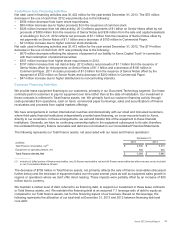

December 31,

(in millions) 2013 2012

Financing debt(1) $4,453 $5,117

Core debt 3,568 3,372

Total Debt $8,021 $8,489

________________

(1) Financing debt includes $3,964 million and $4,649 million as of December 31, 2013 and December 31, 2012, respectively, of debt

associated with Total finance receivables, net and is the basis for our calculation of “Equipment financing interest” expense. The remainder

of the financing debt is associated with Equipment on operating leases.

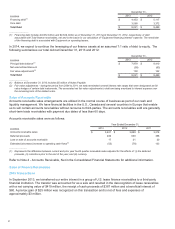

In 2014, we expect to continue the leveraging of our finance assets at an assumed 7:1 ratio of debt to equity. The

following summarizes our total debt at December 31, 2013 and 2012:

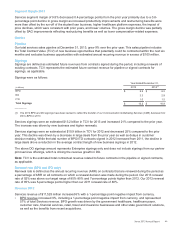

December 31,

(in millions) 2013 2012

Principal debt balance(1) $7,979 $8,410

Net unamortized discount (58)(63)

Fair value adjustments(2) 100 142

Total Debt $8,021 $8,489

________________

(1) Balance at December 31, 2013 includes $5 million of Notes Payable.

(2) Fair value adjustments - during the period from 2004 to 2011, we early terminated several interest rate swaps that were designated as fair

value hedges of certain debt instruments. The associated net fair value adjustments to debt are being amortized to interest expense over

the remaining term of the related notes.

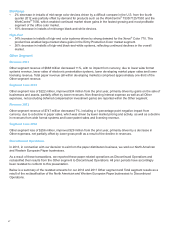

Sales of Accounts Receivable

Accounts receivable sales arrangements are utilized in the normal course of business as part of our cash and

liquidity management. We have financial facilities in the U.S., Canada and several countries in Europe that enable

us to sell certain accounts receivables without recourse to third-parties. The accounts receivables sold are generally

short-term trade receivables with payment due dates of less than 60 days.

Accounts receivable sales were as follows:

Year Ended December 31,

(in millions) 2013 2012 2011

Accounts receivable sales $3,401 $3,699 $3,218

Deferred proceeds 486 639 386

Loss on sale of accounts receivable 17 21 20

Estimated (decrease) increase to operating cash flows(1) (55)(78)133

_______________

(1) Represents the difference between current and prior year fourth quarter receivable sales adjusted for the effects of: (i) the deferred

proceeds, (ii) collections prior to the end of the year, and (iii) currency.

Refer to Note 4 - Accounts Receivable, Net in the Consolidated Financial Statements for additional information.

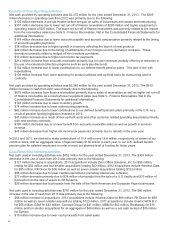

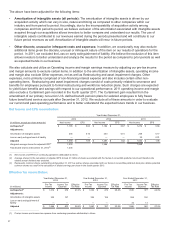

Sales of Finance Receivables

2013 Transactions

In September 2013, we transferred our entire interest in a group of U.S. lease finance receivables to a third-party

financial institution. The transfer was accounted for as a sale and resulted in the derecognition of lease receivables

with a net carrying value of $419 million, the receipt of cash proceeds of $387 million and a beneficial interest of

$60. A pre-tax gain of $25 million was recognized on this transaction and is net of fees and expenses of

approximately $3 million.

51