Xerox 2013 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

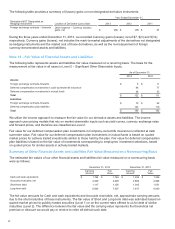

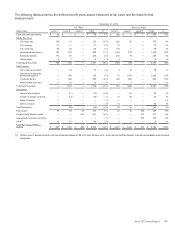

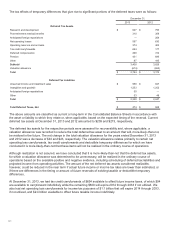

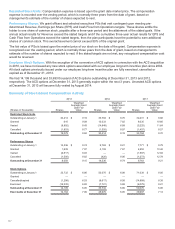

A reconciliation of the U.S. federal statutory income tax rate to the consolidated effective income tax rate was as

follows:

Year Ended December 31,

2013 2012 2011

U.S. federal statutory income tax rate 35.0 % 35.0 %35.0 %

Nondeductible expenses 1.4 % 2.6 % 2.0 %

Effect of tax law changes (0.6)% 0.7 % 0.2 %

Change in valuation allowance for deferred tax assets 0.2 % (0.7)% (0.3)%

State taxes, net of federal benefit 2.6 % 2.1 % 2.4 %

Audit and other tax return adjustments (2.4)% (4.8)% (1.0)%

Tax-exempt income, credits and incentives (3.8)% (2.6)% (3.2)%

Foreign rate differential adjusted for U.S. taxation of foreign profits(1) (11.9)% (12.0)% (10.6)%

Other 0.5 % 0.1 % 0.1 %

Effective Income Tax Rate 21.0 % 20.4 %24.6 %

_____________________________

(1) The “U.S. taxation of foreign profits” represents the U.S. tax, net of foreign tax credits, associated with actual and deemed repatriations of

earnings from our non-U.S. subsidiaries.

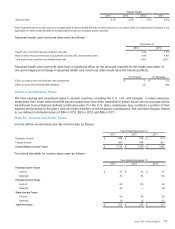

On a consolidated basis, we paid a total of $155, $137 and $94 in income taxes to federal, foreign and state

jurisdictions during the three years ended December 31, 2013, respectively.

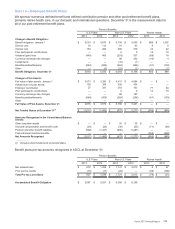

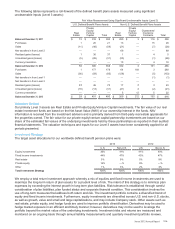

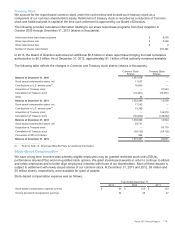

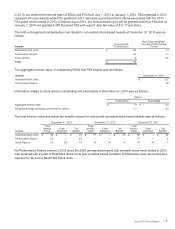

Total income tax expense (benefit) was allocated as follows:

Year Ended December 31,

2013 2012 2011

Pre-tax income $ 276 $272 $377

Discontinued operations 4 5 9

Common shareholders' equity:

Changes in defined benefit plans 318 (233)(277)

Stock option and incentive plans, net (13) (5) 1

Cash flow hedges — (24)3

Translation adjustments (9) (9) 2

Total Income Tax Expense (Benefit) $576 $6$115

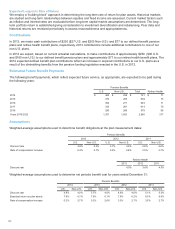

Unrecognized Tax Benefits and Audit Resolutions

We recognize tax liabilities when, despite our belief that our tax return positions are supportable, we believe that

certain positions may not be fully sustained upon review by tax authorities. Each period we assess uncertain tax

positions for recognition, measurement and effective settlement. Benefits from uncertain tax positions are measured

at the largest amount of benefit that is greater than 50 percent likely of being realized upon settlement - the more

likely than not recognition threshold. Where we have determined that our tax return filing position does not satisfy

the more likely than not recognition threshold, we have recorded no tax benefits.

We are also subject to ongoing tax examinations in numerous jurisdictions due to the extensive geographical scope

of our operations. Our ongoing assessments of the more-likely-than-not outcomes of the examinations and related

tax positions require judgment and can increase or decrease our effective tax rate, as well as impact our operating

results. The specific timing of when the resolution of each tax position will be reached is uncertain. As of

December 31, 2013, we do not believe that there are any positions for which it is reasonably possible that the total

amount of unrecognized tax benefits will significantly increase or decrease within the next 12 months.

109