Xerox 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

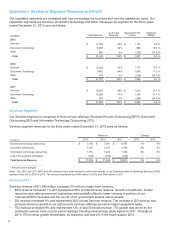

• DO revenue increased 2%, including a 2-percentage point negative impact from currency, and represented 31%

of total Services revenue. The increase in DO revenue was primarily driven by our new partner print services

offerings as well as new signings.

• ITO revenue increased 8% and represented 12% of total Services revenue. ITO growth was driven by the

revenue ramp resulting from strong growth in recent quarters and also includes 3-percentage points of growth

related to revenue from intercompany services, which is eliminated in total Services segment revenue.

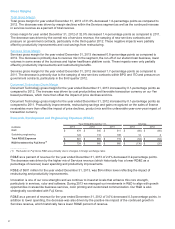

Segment Margin 2012

Services segment margin of 10.2% decreased 0.9-percentage points from the prior year primarily due to a decline

in gross margin, which was driven by the ramping of new services contracts, pressure on government contracts,

the impact of lower contract renewals and lower volumes in some areas of the business. The gross margin decline

was partially offset by the benefits from restructuring and lower SAG, primarily in DO.

Document Technology Segment

Our Document Technology segment includes the sale of products and supplies, as well as the associated

maintenance and financing of those products.

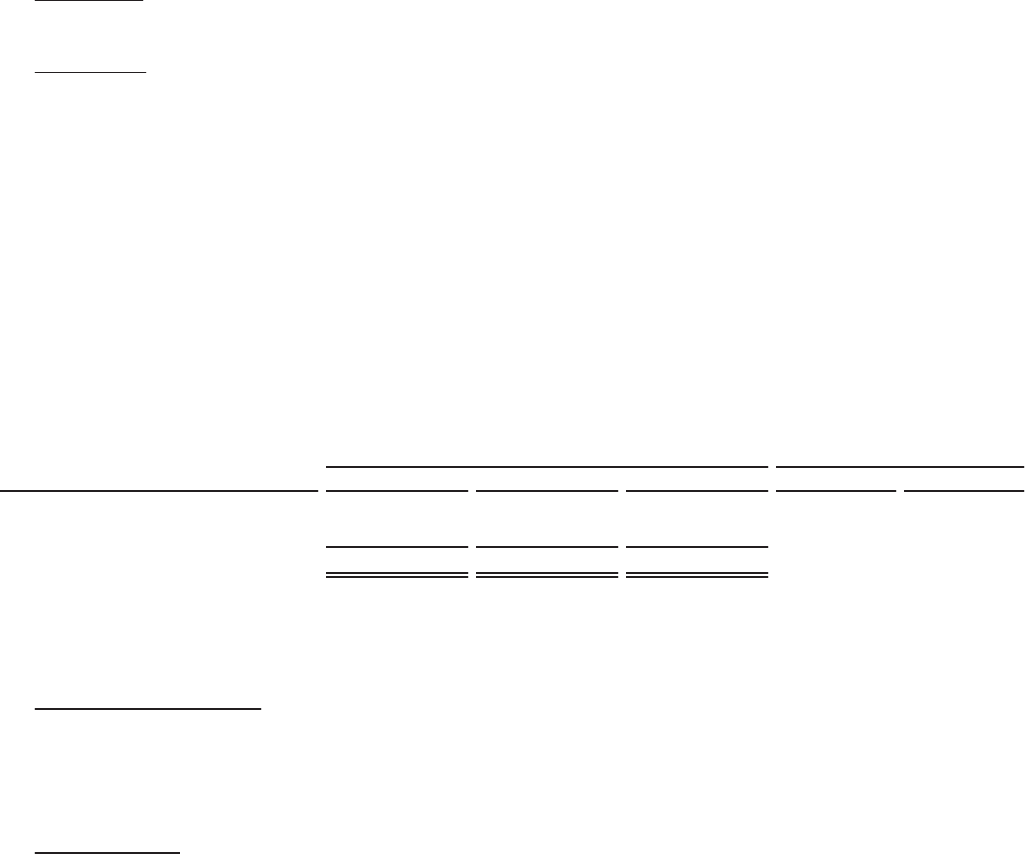

Revenue

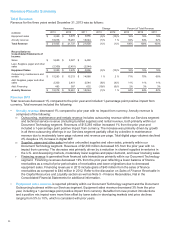

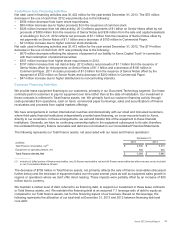

Year Ended December 31, Change

(in millions) 2013 2012 2011 2013 2012

Equipment sales $ 2,727 $2,879 $3,277 (5)% (12)%

Annuity revenue 6,181 6,583 6,982 (6)% (6)%

Total Revenue $8,908 $9,462 $10,259 (6)% (8)%

Revenue 2013

Document Technology revenue of $8,908 million decreased 6%, with no impact from currency. Total revenues

include the following:

• Equipment sales revenue decreased by 5% with a 1-percentage point positive impact from currency. Equipment

sales benefited from our 2013 mid-range product refresh, growth and acquisitions in the small and mid-size

business market and increased demand for color digital production presses. These benefits were more than

offset by the continued migration of customers to managed print services and our growing partner print services

offerings (included in our Services segment), weakness in developing markets and price declines, which were

in the historical 5% to 10% range.

• Annuity revenue decreased by 6%, with no impact from currency, driven by a modest decline in total pages, the

reduction in channel supplies inventory levels, lower sales in developing markets and a decline in financing

revenue as a result of prior period sales of finance receivables and lower originations. Annuity revenue was

also impacted by the continued migration of customers to our partner print services offerings (included in our

Services segment).

Document Technology revenue mix was 21% entry, 58% mid-range and 21% high-end.

Segment Margin 2013

Document Technology segment margin of 10.8% decreased 0.5-percentage points from prior year. The decline was

primarily driven by an increase in SAG as a percent of revenue due to the overall impact of lower revenue and

higher pension settlement losses which were only partially offset by restructuring savings, productivity

improvements and lower compensation-related expenses.

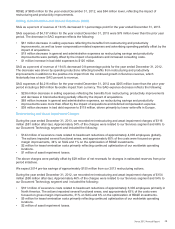

Total revenue declines in 2014 are expected to remain at the mid-single digit level for the Document Technology

segment as projected declines in black-and-white printing are only partially offset with growth in color and in the

graphic communications and SMB markets. The expected 2014 revenue decline for the Document Technology

segment is consistent with the trend we have experienced for this segment over the past three years as we

continue to transform the Company from a technology-based equipment company to a document outsourcing

services-based entity and customers continue to migrate their business to more services-based offerings. These

services-based offerings are reported within our Services segment. This business is also heavily impacted by price

and page declines. Although annual revenue declines are expected in 2014, we believe there will eventually be a

45