Xerox 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

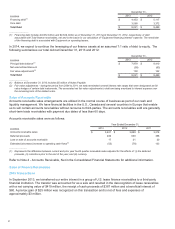

In December 2013, our Canadian subsidiary transferred its entire interest in a group of lease finance receivables to

a third-party trust. The transfer was accounted for as a sale and resulted in the derecognition of lease receivables

with a net carrying value of $257 million, the receipt of cash proceeds of $248 million and a beneficial interest of

$26 million. A pre-tax gain of $15 million was recognized on this transaction and is net of additional fees and

expenses of approximately $1 million.

2012 Transactions

In 2012, we completed similar sale transactions on two separate portfolios of U.S. lease finance receivables with a

combined net carrying value of $682 million to a third-party financial institution for cash proceeds of $630 million

and beneficial interests of $101 million. A pre-tax gain of $44 million was recognized on these transactions and is

net of additional fees and expenses of approximately $5 million.

The gains on these transactions are reported in Finance income in Document Technology segment revenues, as

the sold receivables are from this segment. We will continue to service the sold receivables and expect to a record

servicing fee income over the expected life of the associated receivables. These transactions enable us to lower the

cost associated with our financing portfolio.

Refer to Note 5 - Finance Receivables, Net in the Consolidated Financial Statements for additional information.

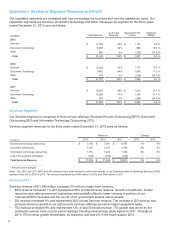

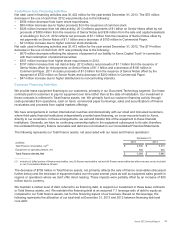

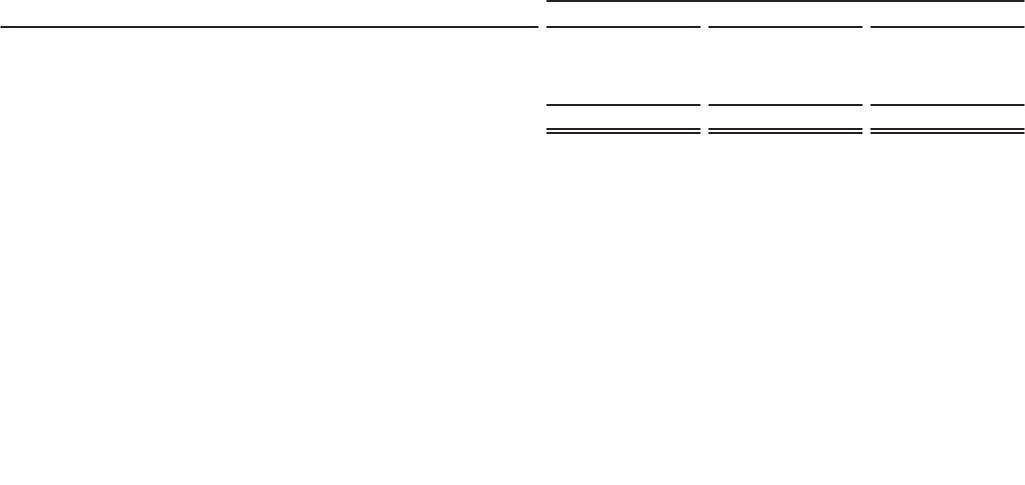

The net impact on operating cash flows from the sales of finance receivables is summarized below:

Year Ended December 31,

(in millions) 2013 2012 2011

Net cash received for sales of finance receivables(1) $631 $625 $—

Impact from prior sales of finance receivables(2) (392)(45)—

Collections on beneficial interest 58 — —

Estimated Increase to Operating Cash Flows $297 $580 $—

______________

(1) Net of beneficial interest, fees and expenses

(2) Represents cash that would have been collected if we had not sold finance receivables.

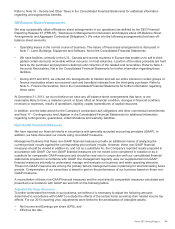

Capital Market Activity

Senior Notes

In December 2013, we issued $500 million of 2.75% Senior Notes due 2019 (the “2019 Senior Notes”). The 2019

Senior Notes accrue interest at a rate of 2.75% per annum and are payable semi-annually. The 2019 Senior Notes

were issued at 99.915% of par, resulting in aggregate net proceeds essentially at par. In connection with the

issuance of these Senior Notes, debt issuance costs of $4 million were deferred.

The December 2013 Senior Note issuance was approximately $200 million higher than originally planned and we

expect to use that excess to partially fund the $1.1 billion in Senior Notes maturing in May 2014. The remainder of

the proceeds from this offering were used for general corporate purposes.

Refer to Note 12- Debt in the Consolidated Financial Statements for additional information regarding our debt.

Financial Instruments

Refer to Note 13 - Financial Instruments in the Consolidated Financial Statements for additional information

regarding our derivative financial instruments.

Share Repurchase Programs - Treasury Stock

During 2013, we repurchased 65.2 million shares of our common stock for an aggregate cost of $696 million,

including fees. In November 2013, the Board of Directors authorized an additional $500 million in share

repurchases bringing the total cumulative authorization to $6.5 billion.

Through February 18, 2014, we repurchased an additional 15.8 million shares at an aggregate cost of $175.1

million, including fees, for total program repurchases of 509.3 million shares at a cost of $5.6 billion, including fees.

Xerox 2013 Annual Report 52