Xerox 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

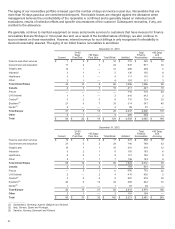

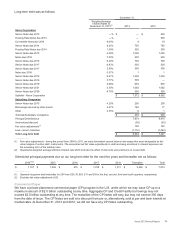

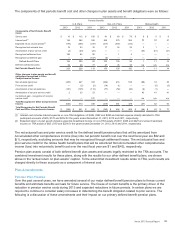

Long-term debt was as follows:

December 31,

Weighted Average

Interest Rates at

December 31, 2013(2) 2013 2012

Xerox Corporation

Senior Notes due 2013 —% $ —$400

Floating Rate Notes due 2013 —% — 600

Convertible Notes due 2014 9.00%919

Senior Notes due 2014 8.25%750 750

Floating Rate Notes due 2014 1.06%300 300

Senior Notes due 2015 4.29%1,000 1,000

Notes due 2016 7.20%250 250

Senior Notes due 2016 6.48%700 700

Senior Notes due 2017 6.83%500 500

Senior Notes due 2017 2.98%500 500

Notes due 2018 0.57%1 1

Senior Notes due 2018 6.37%1,000 1,000

Senior Notes due 2019 2.77%500 —

Senior Notes due 2019 5.66%650 650

Senior Notes due 2021 5.39%1,062 1,062

Senior Notes due 2039 6.78%350 350

Subtotal - Xerox Corporation $ 7,572 $8,082

Subsidiary Companies

Senior Notes due 2015 4.25%250 250

Borrowings secured by other assets 3.47%146 77

Other 0.35%6 1

Subtotal-Subsidiary Companies $ 402 $328

Principal Debt Balance 7,974 8,410

Unamortized discount (58)(63)

Fair value adjustments(1) 100 142

Less: current maturities (1,112) (1,042)

Total Long-term Debt $6,904 $7,447

_______________

(1) Fair value adjustments - during the period from 2004 to 2011, we early terminated several interest rate swaps that were designated as fair

value hedges of certain debt instruments. The associated net fair value adjustments to debt are being amortized to interest expense over

the remaining term of the related notes.

(2) Represents weighted average effective interest rate which includes the effect of discounts and premiums on issued debt.

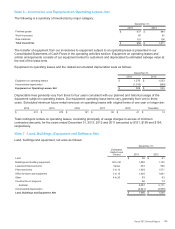

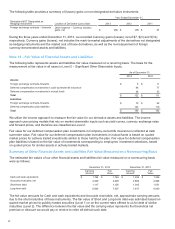

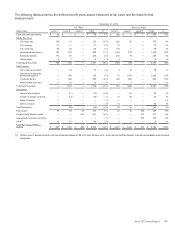

Scheduled principal payments due on our long-term debt for the next five years and thereafter are as follows:

2014(1)(2) 2015 2016 2017 2018 Thereafter Total

$ 1,107 $ 1,283 $ 975 $ 1,018 $1,011 $2,580 $7,974

_________________

(1) Quarterly long-term debt maturities for 2014 are $24, $1,063, $11 and $9 for the first, second, third and fourth quarters, respectively.

(2) Excludes fair value adjustment of $5.

Commercial Paper

We have a private placement commercial paper (CP) program in the U.S. under which we may issue CP up to a

maximum amount of $2.0 billion outstanding at any time. Aggregate CP and Credit Facility borrowings may not

exceed $2.0 billion outstanding at any time. The maturities of the CP Notes will vary, but may not exceed 390 days

from the date of issue. The CP Notes are sold at a discount from par or, alternatively, sold at par and bear interest at

market rates. At December 31, 2013 and 2012, we did not have any CP Notes outstanding.

Xerox 2013 Annual Report 94