Xerox 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

93Xerox 2010 Annual Report

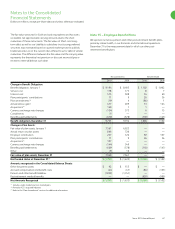

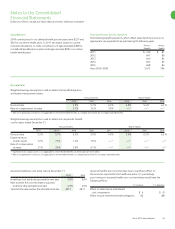

Estimated Future Benefit Payments

The following benefit payments, which reflect expected future service, as

appropriate, are expected to be paid during the following years:

Pension Retiree

Benefits Health

2011 $ 749 $ 87

2012 647 86

2013 644 85

2014 653 85

2015 668 84

Years 2016–2020 3,473 396

Assumed healthcare cost trend rates have a significant effect on

the amounts reported for the healthcare plans. A 1-percentage-

point change in assumed health care cost trend rates would have the

following effects:

1% increase 1% decrease

Effect on total service and interest

cost components $ 6 $ (5)

Effect on post-retirement benefit obligation 82 (68)

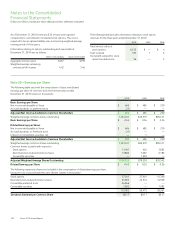

Contributions

2010 contributions for our defined benefit pension plans were $237 and

$92 for our retiree health plans. In 2011 we expect, based on current

actuarial calculations, to make contributions of approximately $500 to

our defined benefit pension plans and approximately $90 to our retiree

health benefit plans.

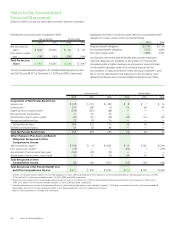

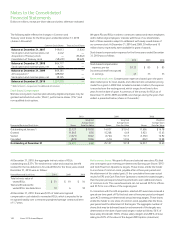

Assumed healthcare cost trend rates at December 31,

2010 2009

Healthcare cost trend rate assumed for next year 9.0% 9.8%

Rate to which the cost trend rate is assumed

to decline (the ultimate trend rate) 4.9% 4.9%

Year that the rate reaches the ultimate trend rate 2017 2017

Assumptions

Weighted-average assumptions used to determine benefit obligations

at the plan measurement dates:

Pension Benefits Retiree Health

2010 2009 2008 2010 2009 2008

Discount rate 5.2% 5.7% 6.3% 4.9% 5.4% 6.3%

Rate of compensation increase 3.1% 3.6% 3.9% —(1) —

(1) —

(1)

(1) Rate of compensation increase is not applicable to the retiree health benefits, as compensation levels do not impact earned benefits.

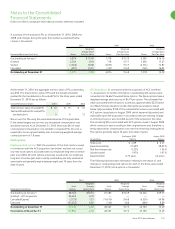

Weighted-average assumptions used to determine net periodic benefit

cost for years ended December 31:

Pension Benefits Retiree Health

2011 2010 2009 2008 2011 2010 2009 2008

Discount rate 5.2% 5.7% 6.3% 5.9% 4.9% 5.4% 6.3% 6.2%

Expected return

on plan assets 7.2% 7.3% 7.4% 7.6% —(1) —

(1) —

(1) —

(1)

Rate of compensation

increase 3.1% 3.6% 3.9% 4.1% —(2) —

(2) —

(2) —

(2)

(1) Expected return on plan assets is not applicable to retiree health benefits, as these plans are not funded.

(2) Rate of compensation increase is not applicable to retiree health benefits, as compensation levels do not impact earned benefits.