Xerox 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

101Xerox 2010 Annual Report

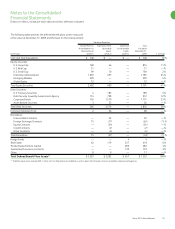

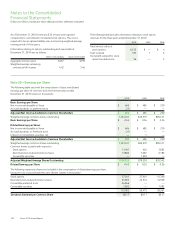

A summary of the activity for PSs as of December 31, 2010, 2009 and

2008, and changes during the years then ended, is presented below

(shares in thousands):

2010 2009 2008

Weighted Weighted Weighted

Average Grant Average Grant Average Grant

Nonvested Restricted Stock Units Shares Date Fair Value Shares Date Fair Value Shares Date Fair Value

Outstanding at January 1 4,874 $ 15.49 7,378 $ 15.39 6,585 $ 16.16

Granted 5,364 8.10 718 15.17 3,696 13.67

Vested (1,566) 18.48 (3,075) 15.17 (2,734) 14.87

Cancelled (901) 15.51 (147) 15.52 (169) 16.05

Outstanding at December 31

7,771 9.78 4,874 15.49 7,378 15.39

ACS Acquisition: In connection with the acquisition of ACS (see Note

3 – Acquisitions for further information), outstanding ACS options were

converted into 96,662 thousand Xerox options. The Xerox options have a

weighted average exercise price of $6.79 per option. The estimated fair

value associated with the options issued was approximately $222 based

on a Black-Scholes valuation model utilizing the assumptions stated

below. Approximately $168 of the estimated fair value is associated with

ACS options issued prior to August 2009, which became fully vested and

exercisable upon the acquisition in accordance with pre-existing change-

in-control provisions, was recorded as part of the acquisition fair value.

The remaining $54 is associated with ACS options issued in August 2009

which continue to vest according to their original terms and, therefore, is

being expensed as compensation cost over the remaining vesting period.

The options generally expire 10 years from date of grant.

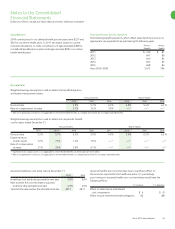

Pre-August 2009 August 2009

Assumptions Options Options

Strike price $ 6.89 $ 6.33

Expected volatility 37.90% 38.05%

Risk-free interest rate 0.23% 1.96%

Dividend yield 1.97% 1.97%

Expected term 0.75 years 4.2 years

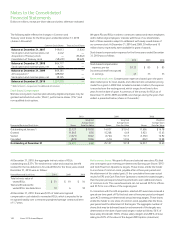

The following table provides information relating to the status of, and

changes in, outstanding stock options for each of the three years ended

December 31, 2010 (stock options in thousands):

At December 31, 2010, the aggregate intrinsic value of PSs outstanding

was $90. The total intrinsic value of PSs and the actual tax benefit

realized for the tax deductions for vested PSs for the three years ended

December 31, 2010 was as follows:

Vested Performance Shares 2010 2009 2008

Total intrinsic value of vested PSs $ 12 $ 15 $ 41

Tax benefit realized for vested PSs

tax deductions 5 6 13

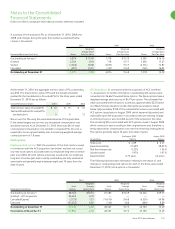

We account for PSs using fair value determined as of the grant date.

If the stated targets are not met, any recognized compensation cost

would be reversed. As of December 31, 2010, there was $45 of total

unrecognized compensation cost related to nonvested PSs; this cost is

expected to be recognized ratably over a remaining weighted-average

contractual term of 1.8 years.

Stock options

Employee stock options: With the exception of the stock options issued

in connection with the ACS acquisition (see below), we have not issued

any new stock options associated with our employee long-term incentive

plan since 2004. All stock options previously issued under our employee

long-term incentive plan and currently outstanding are fully vested and

exercisable and generally expire between eight and 10 years from the

date of grant.

2010 2009 2008

Weighted Weighted Weighted

Stock Average Stock Average Stock Average

Employee Stock Options Options Option Price Options Option Price Options Option Price

Outstanding at January 1 28,363 $10.13 45,185 $15.49 52,424 $19.73

Granted – ACS acquisition 96,662 6.79 — — — —

Cancelled/Expired (2,735) 7.33 (16,676) 24.68 (6,559) 50.08

Exercised (51,252) 6.92 (146) 5.88 (680) 8.89

Outstanding at December 31 71,038 8.00 28,363 10.13 45,185 15.49

Exercisable at December 31 57,985 8.38 28,363 10.13 45,185 15.49