Xerox 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

92 Xerox 2010 Annual Report

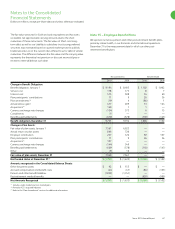

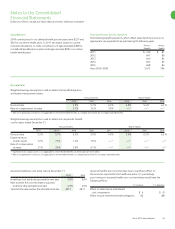

The following table represents a roll-forward of the defined benefit plans

assets measured using significant unobservable inputs (Level 3 assets):

Fair Value Measurement Using Significant Unobservable Inputs (Level 3)

Private Guaranteed

Equity/Venture Insurance

Hedge Funds Real Estate Capital Contracts Other Total

December 31, 2008 $ 3 $ 279 $ 331 $ 104 $ — $ 717

Net payments, purchases and sales 1 5 16 1 — 23

Net transfers in (out) — — — 16 — 16

Realized gains (losses) — — 8 3 (1) 10

Unrealized gains (losses) — (66) (69) 2 1 (132)

Currency translation — 19 — 4 — 23

December 31, 2009 4 237 286 130 — 657

Net payments, purchases and sales — 7 (8) (12) — (13)

Net transfers in (out) — — — 1 — 1

Realized gains (losses) — 5 28 (2) — 31

Unrealized gains (losses) — 22 — (2) — 20

Currency translation — (6) — (9) — (15)

Other — 10 1 (9) (1) 1

December 31, 2010 $ 4 $ 275 $ 307 $ 97 $ (1) $ 682

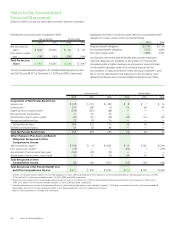

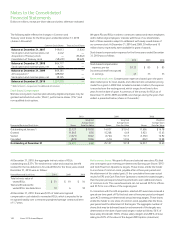

Our pension plan assets and benefit obligations at December 31, 2010

were as follows:

Fair Value of Pension Funded

Pension Plan Benefit Status

(in billions) Assets Obligations Status

U.S. $ 3.2 $ 4.4 $ (1.2)

U.K. 2.9 2.9 —

Canada 0.6 0.8 (0.2)

Other 1.2 1.6 (0.4)

Total $ 7.9 $ 9.7 $ (1.8)

Investment Strategy

The target asset allocations for our worldwide plans for 2010 and 2009

were:

2010 2009

Equity investments 42% 41%

Fixed income investments 45% 45%

Real estate 7% 7%

Private equity 4% 4%

Other 2% 3%

Total Investment Strategy 100% 100%

We employ a total return investment approach whereby a mix of

equities and fixed income investments are used to maximize the long-

term return of plan assets for a prudent level of risk. The intent of this

strategy is to minimize plan expenses by exceeding the interest growth

in long-term plan liabilities. Risk tolerance is established through careful

consideration of plan liabilities, plan funded status and corporate

financial condition. This consideration involves the use of long-term

measures that address both return and risk. The investment portfolio

contains a diversified blend of equity and fixed income investments.

Furthermore, equity investments are diversified across U.S. and non-

U.S. stocks, as well as growth, value and small and large capitalizations.

Other assets such as real estate, private equity and hedge funds are

used to improve portfolio diversification. Derivatives may be used to

hedge market exposure in an efficient and timely manner; however,

derivatives may not be used to leverage the portfolio beyond the market

value of the underlying investments. Investment risks and returns are

measured and monitored on an ongoing basis through annual liability

measurements and quarterly investment portfolio reviews.

Expected Long-term Rate of Return

We employ a “building block” approach in determining the long-term

rate of return for plan assets. Historical markets are studied and long-

term relationships between equities and fixed income are assessed.

Current market factors such as inflation and interest rates are evaluated

before long-term capital market assumptions are determined. The long-

term portfolio return is established giving consideration to investment

diversification and rebalancing. Peer data and historical returns are

reviewed periodically to assess reasonableness and appropriateness.