Xerox 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

67Xerox 2010 Annual Report

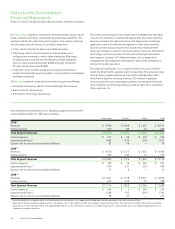

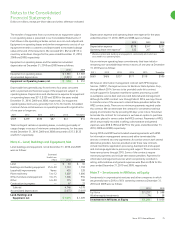

The following is a reconciliation of segment profit to pre-tax income

(loss) for the three years ended December 31, 2010:

2010 2009 2008

Total Segment Profit $ 1,875 $ 838 $ 1,345

Reconciling items:

Restructuring and asset impairment charges (483) 8 (429)

Restructuring charges of Fuji Xerox (38) (46) (16)

Acquisition-related costs (77) (72) —

Amortization of intangible assets (312) (60) (54)

Venezuelan devaluation costs (21) — —

ACS shareholders’ litigation settlement (36) — —

Litigation matters(1) — — (774)

Loss on early extinguishment of debt (15) — —

Equity in net income of unconsolidated affiliates (78) (41) (113)

Equipment write-off and other — — (38)

Pre-tax Income (Loss) $ 815 $ 627 $ (79)

(1) The 2008 provision for litigation represents $670 for the Carlson v. Xerox Corporation court-approved settlement, as well as provisions for other litigation matters including

$36 for the probable loss related to the Brazil labor-related contingencies.

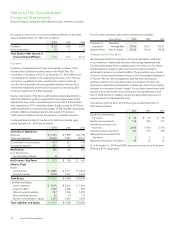

Geographic area data is based upon the location of the subsidiary

reporting the revenue or long-lived assets and is as follows for the three

years ended December 31, 2010:

Revenues Long-Lived Assets(1)

2010 2009 2008 2010 2009 2008

United States $ 13,801 $ 8,156 $ 9,122 $ 1,764 $ 1,245 $ 1,386

Europe 5,332 4,971 6,011 741 717 680

Other areas 2,500 2,052 2,475 309 262 248

Total Revenues and Long-Lived Assets $ 21,633 $ 15,179 $ 17,608 $ 2,814 $ 2,224 $ 2,314

(1) Long-lived assets are comprised of (i) land, buildings and equipment, net, (ii) equipment on operating leases, net, (iii) internal use software, net and (iv) product software, net.

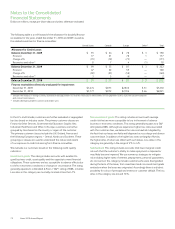

Equity transaction: Each outstanding share of ACS Class A and Class

B common stock was converted into a combination of 4.935 shares

of Xerox common stock and $18.60 in cash for a combined value of

$60.40 per share, or approximately $6.0 billion based on the closing

price of Xerox common stock of $8.47 on the acquisition date. 489,802

thousand shares of Xerox common stock were issued. We also issued

convertible preferred stock with a liquidation value of $300 and a fair

value of $349 as of the acquisition date to ACS’s Class B shareholder.

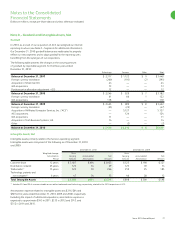

Note 3 – Acquisitions

Affiliated Computer Services, Inc.

On February 5, 2010 (“the acquisition date”), we acquired all of the

outstanding equity of ACS in a cash-and-stock transaction valued at

approximately $6.5 billion. ACS provides business process outsourcing

and information technology (“ITO”) services and solutions to commercial

and government clients worldwide. ACS delivers a full range of BPO and

IT services, as well as end-to-end solutions to the public and private

sectors and supports a variety of industries including education, energy,

financial, government, healthcare, retail and transportation. ACS’s

revenues for the calendar year ended December 31, 2009 were $6.6

billion and they employed 78,000 people and operated in over 100

countries on the acquisition date.