Xerox 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

84 Xerox 2010 Annual Report

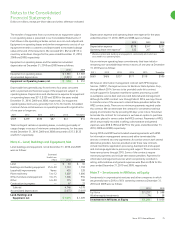

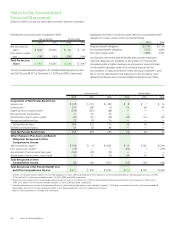

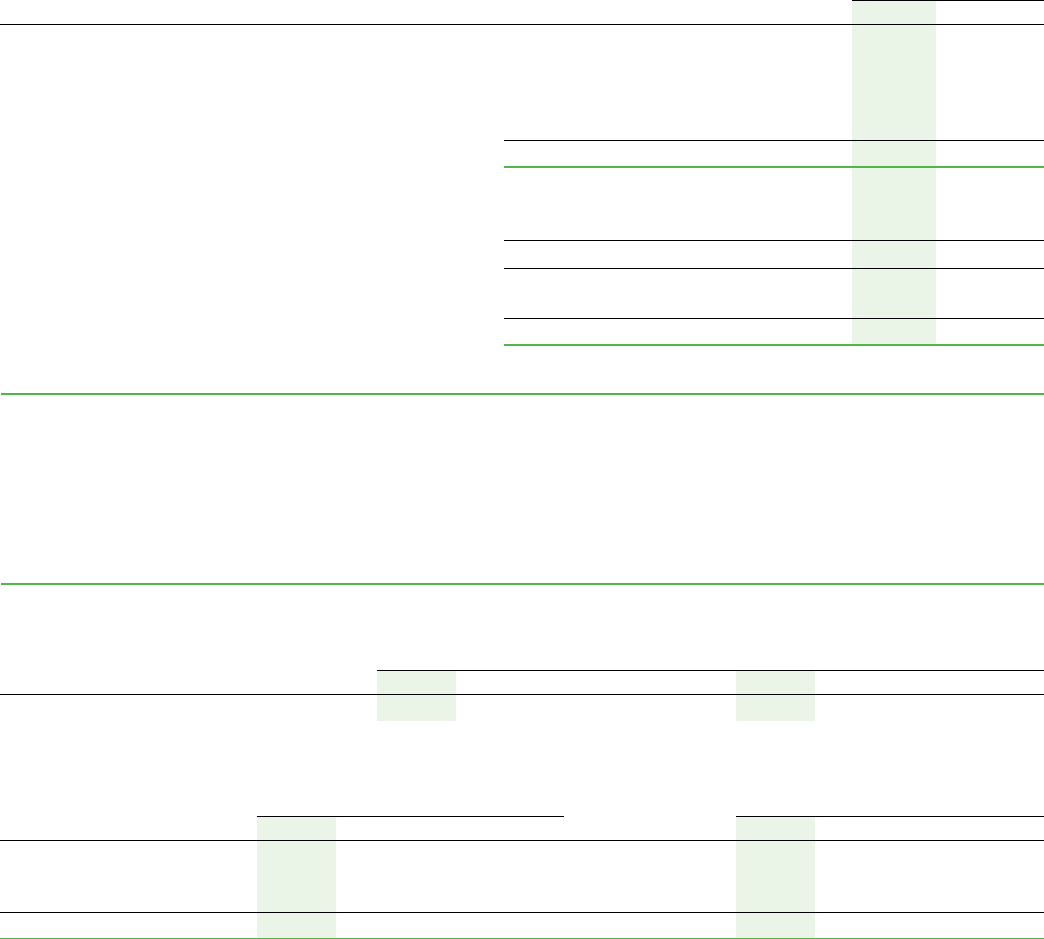

Summary of Derivative Instruments Fair Values

The following table provides a summary of the fair value amounts of

derivative instruments at December 31, 2010 and 2009, respectively.

Fair Value

Designation of Derivatives Balance Sheet Location 2010 2009

Derivatives Designated as Hedging Instruments

Foreign exchange contracts – forwards Other current assets $ 19 $ 4

Other current liabilities (1) (3)

Interest rate swaps Other long-term assets 11 10

Other long-term liabilities — (9)

Net Designated Assets $ 29 $ 2

Derivatives NOT Designated as Hedging Instruments

Foreign exchange contracts – forwards Other current assets $ 26 $ 12

Other current liabilities (18) (12)

Net Undesignated Assets $ 8 $ —

Summary of Derivatives Total Derivative Assets $ 56 $ 26

Total Derivative Liabilities (19) (24)

Net Derivative Asset $ 37 $ 2

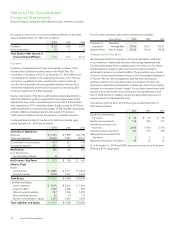

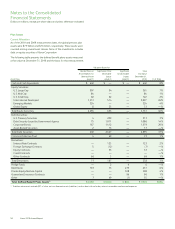

Location of Gain Derivative Gain (Loss) Hedged Item Gain (Loss)

Derivatives in Fair Value (Loss) Recognized Recognized in Income Recognized in Income

Hedging Relationships in Income 2010 2009 2008 2010 2009 2008

Interest rate contracts Interest expense $99 $(18) $206 $(99) $18 $(206)

Location of

Derivative Gain (Loss) Derivative Gain (Loss) Gain (Loss)

Recognized in OCI Reclassified from Reclassified from AOCI

Derivatives in Cash Flow (Effective Portion) AOCI into Income to Income (Effective Portion)

Hedging Relationships 2010 2009 2008 (Effective Portion) 2010 2009 2008

Interest rate contracts $ — $ — $ (2) Interest expense $ — $ — $ —

Foreign exchange contracts –

forwards 46 (1) 4 Cost of sales 28 2 2

Total Cash Flow Hedges $ 46 $ (1) $ 2 $ 28 $ 2 $ 2

No amount of ineffectiveness was recorded in the Consolidated

Statements of Income for these designated cash flow hedges and all

components of each derivative’s gain or loss was included in the

assessment of hedge effectiveness.

Summary of Derivative Instruments Gains (Losses)

Derivative gains and losses affect the income statement based on

whether such derivatives are designated as hedges of underlying

exposures. The following is a summary of derivative gains and losses.

Designated Derivative Instruments Gains (Losses)

The following table provides a summary of the gains and losses

on designated derivative instruments for the three years ended

December 31, 2010: