Xerox 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26 Xerox 2010 Annual Report

The following Management’s Discussion and Analysis (“MD&A”)

is intended to help the reader understand the results of operations

and financial condition of Xerox Corporation. MD&A is provided

as a supplement to, and should be read in conjunction with, our

consolidated financial statements and the accompanying notes.

Throughout this document, references to “we,” “our,” the “Company”

and “Xerox” refer to Xerox Corporation and its subsidiaries. References

to “Xerox Corporation” refer to the stand-alone parent company and

do not include its subsidiaries.

Executive Overview

We are a $22 billion leading global enterprise for business process and

document management. We provide the industry’s broadest portfolio of

document systems and services for businesses of any size. This includes

printers, multifunction devices, production publishing systems, managed

print services (“MPS”) and related software. We also offer financing,

service and supplies, as part of our document technology offerings. In

2010, we acquired Affiliated Computer Services, Inc. (“ACS”). Through

ACS we offer extensive business process outsourcing and information

technology outsourcing services, including data processing, HR benefits

management, finance support and customer relationship management

services for commercial and government organizations worldwide.

We operate in a market that is estimated to be $500 billion. We have

136,500 employees and serve customers in more than 160 countries.

Approximately 36% of our revenue is generated from customers outside

the U.S.

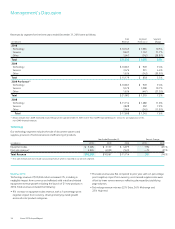

We organize our business around two segments: Technology and

Services.

Our

• Technology segment comprises our business of providing

customers with document technology and related supplies, technical

service and equipment financing. Our product categories within this

segment include Entry, Mid-range and High-End products.

Our

• Services segment is comprised of our business process

outsourcing, information technology outsourcing and document

outsourcing services. Because we participate in all three of these

lines of business, we are uniquely positioned in the industry, and

we believe this allows us to provide a differentiated solution and

deliver greater value to our customers.

The fundamentals of our business rest upon an annuity model that

drives significant recurring revenue and cash generation. Over 80%

of our 2010 total revenue was annuity-based revenue that includes

contracted services, equipment maintenance and consumable supplies,

among other elements. Some of the key indicators of annuity revenue

growth include:

The number of page-producing machines-in-the-field (“MIF”), which

•

is impacted by equipment installations

Page volume and the mix of color pages, as color pages generate

•

more revenue per page than black-and-white

Services signings growth, which reflects the year-over-year increase

•

in estimated future revenues from contracts signed during the period

as measured on a trailing12-month basis

Services pipeline growth, which measures the year-over-year increase

•

in new business opportunities

Subsequent to the acquisition of ACS, we acquired three additional

service companies, further expanding our BPO capabilities:

In July 2010, we acquired ExcellerateHRO, LLP (“EHRO”), a global

•

benefits administration and relocation services provider

In October 2010, we acquired TMS Health (“TMS”), a U.S.-based

•

teleservices company that provides customer care services to the

pharmaceutical, biotech and healthcare industries

In November 2010, we acquired Spur Information Solutions (“Spur”),

•

one of the United Kingdom’s leading providers of computer software

used for parking enforcement

Additionally, in 2010 we acquired two companies to further expand

our distribution capacity:

In January 2010, we acquired Irish Business Systems Limited

•

(“IBS”) to expand our reach into the small and mid-size business

market in Ireland

In September 2010, we acquired Georgia Duplicating Products

•

(“Georgia”), an office equipment supplier

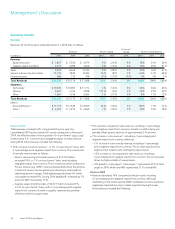

Financial Overview

During 2010, despite the continued economic weakness, we began

to see improvement in our markets. Results remained strong in our

developing markets countries as well as in the small to mid-size business

market. We began to see increased demand and usage activity in large

enterprise customers, particularly in the fourth quarter 2010. We closed

2010 with strong revenue growth, operating margin expansion and

excellent cash generation, reflecting the strength of our business model

and the benefits of our expanded technology and service offerings.

Management’s Discussion and Analysis of

Financial Condition and Results of Operations