Xerox 2010 Annual Report Download - page 62

Download and view the complete annual report

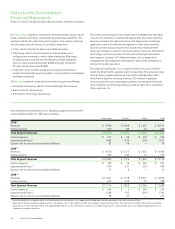

Please find page 62 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

60 Xerox 2010 Annual Report

We adopted these updates effective for our fiscal year beginning January

1, 2010 and are applying them prospectively from that date for new

or materially modified arrangements. The adoption of these updates

did not have a material effect on our financial condition or results of

operations. See “Summary of Accounting Policies – Revenue recognition

– Multiple Element Arrangements” for further information regarding our

adoption of ASU No. 2009-13.

With respect to the new software guidance in ASU No. 2009-14, the

modification in the scope of the industry-specific software revenue

recognition guidance did not result in a change in the recognition of

revenue for our equipment and services. Software included within our

equipment and services has generally been considered incidental and

therefore has been, and will continue to be, accounted for as part of

the sale of equipment or services. Most of our equipment have both

software and non-software components that function together to deliver

the equipment’s essential functionality. The software scope modification

is also not expected to change the recognition of revenue for software

accessories sold in connection with our equipment or free-standing

software sales as these transactions will continue to be accounted for

under the industry-specific software revenue recognition guidance as

separate software elements. See “Summary of Accounting Policies –

Revenue Recognition – Software” for further information.

Other Accounting Changes

In 2010, the FASB issued the following codification updates:

ASU 2010-19

• which amended Foreign Currency (ASC Topic 830).

The purpose of this update was to codify the SEC staff’s view on

certain foreign currency issues related to investments in Venezuela.

See “Foreign Currency Translation and Re-measurement” section

below for further information regarding our operations in Venezuela.

ASU 2010-20

• which amended Receivables (ASC Topic 310) and

requires significantly increased disclosures regarding the credit

quality of an entity’s financing receivables and its allowance for

credit losses. In addition, this update requires an entity to disclose

credit quality indicators past due information, and modifications

of its financing receivables. The disclosures are first effective for our

2010 Annual Report. The principal impact from this update was

increased disclosures concerning the details of finance receivables

and the related provisions and reserves for credit losses. See Note

4 – Receivables, Net for the disclosures required by this update.

In 2009, the FASB issued the following codification updates:

ASU 2009-16

• which amended Transfers and Servicing (ASC Topic 860):

Accounting for Transfers of Financial Assets. This update removed

the concept of a qualifying special-purpose entity and removed the

exception from applying consolidation guidance to these entities. This

update also clarified the requirements for isolation and limitations on

portions of financial assets that are eligible for sale accounting. We

adopted this update effective for our fiscal year beginning January 1,

2010. Certain accounts receivable sale arrangements were modified in

order to qualify for sale accounting under this updated guidance. The

adoption of this update did not have a material effect on our financial

condition or results of operations.

ASU 2009-17

• which amended Consolidations (ASC Topic 810):

Improvements to Financial Reporting by Enterprises Involved

with Variable Interest Entities. This update required an analysis to

determine whether a variable interest gives the entity a controlling

financial interest in a variable interest entity. It also required an

ongoing reassessment and eliminates the quantitative approach

previously required for determining whether an entity is the primary

beneficiary. We adopted this update effective for our fiscal year

beginning January 1, 2010 and the adoption did not have a material

effect on our financial condition or results of operations.

Since the implementation of the codification, the FASB has issued

several ASUs. Except for the ASUs discussed above, the remaining

ASUs issued by the FASB entail technical corrections to existing

guidance or affect guidance related to unique/infrequent transactions

or specialized industries/entities and therefore have minimal, if any,

impact on the Company.

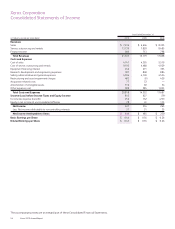

Summary of Accounting Policies

Revenue Recognition

We generate revenue through services, the sale and rental of equipment,

supplies and income associated with the financing of our equipment

sales. Revenue is recognized when earned. More specifically, revenue

related to services and sales of our products is recognized as follows:

Equipment: Revenues from the sale of equipment, including those from

sales-type leases, are recognized at the time of sale or at the inception

of the lease, as appropriate. For equipment sales that require us to install

the product at the customer location, revenue is recognized when the

equipment has been delivered and installed at the customer location.

Sales of customer-installable products are recognized upon shipment

or receipt by the customer according to the customer’s shipping terms.

Revenues from equipment under other leases and similar arrangements

are accounted for by the operating lease method and are recognized as

earned over the lease term, which is generally on a straight-line basis.

Services: Technical service revenues are derived primarily from

maintenance contracts on our equipment sold to customers and are

recognized over the term of the contracts. A substantial portion of our

products are sold with full service maintenance agreements for which

the customer typically pays a base service fee plus a variable amount

based on usage. As a consequence, other than the product warranty

obligations associated with certain of our low-end products, we do

not have any significant product warranty obligations, including any

obligations under customer satisfaction programs.

Revenues associated with outsourcing services are generally recognized

as services are rendered, which is generally on the basis of the number

of accounts or transactions processed. Information technology

processing revenues are recognized as services are provided to the

customer, generally at the contractual selling prices of resources

consumed or capacity utilized by our customers. In those service

arrangements where final acceptance of a system or solution by the