Xerox 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37Xerox 2010 Annual Report

Management’s Discussion

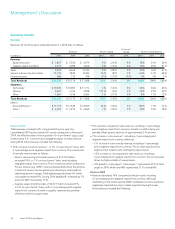

Costs, Expenses and Other Income

Gross Margin

Gross margins by revenue classification were as follows:

Pro-forma(1)

Year Ended December 31, Change Change

2010 2009 2008 2010 2009 2010

Sales 34.5% 33.9% 33.7% 0.6 pts 0.2 pts 1.1 pts

Service, outsourcing and rentals 33.1% 42.6% 41.9% (9.5) pts 0.7 pts (0.7) pts

Finance income 62.7% 62.0% 61.8% 0.7 pts 0.2 pts 0.7 pts

Total Gross Margin 34.4% 39.7% 38.9% (5.3) pts 0.8 pts (0.2) pts

Since a large portion of our inventory is procured from Japan, the

strengthening of the Yen versus the U.S. Dollar and Euro in 2010 and

2009 has significantly impacted our product costs. In 2010, the Yen

strengthened approximately 6% against the U.S. Dollar and 10%

against the Euro as compared to 2009. In 2009, the Yen strengthened

approximately 10% against the U.S. Dollar and 15% against the Euro

as compared to 2008. We expect product costs and gross margins to

continue to be negatively impacted in 2011, particularly in the first half,

if Yen exchange rates remain at January 2011 levels.

(1) Refer to the “Non-GAAP Financial Measures” section for an explanation of the

Pro-forma non-GAAP financial measure.

GrossMargin2009

Totalgrossmargin

• increased 0.8-percentage points compared to

2008, primarily driven by cost improvements, enabled by restructuring

and our cost actions, which were partially offset by the 0.5-percentage

point unfavorable impact of transaction currency, primarily the Yen,

and price declines of 1.0-percentage point.

Salesgrossmargin

• increased 0.2-percentage points, primarily due

to the cost improvements and the positive mix of revenues partially

offset by the adverse impact of transaction currency on our inventory

purchases of 1.0-percentage point and price declines of 1.2-

percentage points.

Service,outsourcingandrentalsmargin

• increased 0.7-percentage

points primarily due to the positive impact from the reduction in costs

driven by our restructuring and cost actions of 1.5-percentage points.

These cost improvements more than offset the approximate 0.9-

percentage point impact of pricing.

Financingincomemargin

• of 62% remained comparable to 2008.

GrossMargin2010

The 2010 total gross margin decreased 5.3-percentage points, and

service, outsourcing and rentals gross margin decreased 9.5-percentage

points, on an actual basis primarily due to the ACS acquisition. ACS, as

a services-based company, had a lower gross margin as compared to a

technology-based company, which typified Xerox before the acquisition.

Since actual comparisons are not meaningful, gross margins for these

two categories are primarily discussed below on a pro-forma basis

with ACS’s 2009 estimated results from February 6 through December

31 included in our historical 2009 results (see “Non-GAAP Financial

Measures” section for a further discussion of this non-GAAP measure).

Totalgrossmargin

• decreased 5.3-percentage points or 0.2-

percentage points on a pro-forma(1) basis, as compared to 2009.

The decline was primarily due to the unfavorable impact of year-

over-year transaction currency.

Salesgrossmargin

• increased 0.6-percentage points or 1.1-

percentage points on a pro-forma(1) basis, as compared to 2009. Cost

improvements and positive mix more than offset a 0.5-percentage

point adverse impact from transaction currency and price declines of

about 1-percentage point.

Service,outsourcingandrentalsgrossmargin

• decreased 9.5-

percentage points or 0.7-percentage points on a pro-forma(1) basis,

as compared to 2009, as price declines and the higher rate of growth

in lower-margin BPO revenue were only partially offset by cost

improvements.

Financingincomegrossmargin

• of 62.7% remained comparable

to 2009.