Xerox 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

59Xerox 2010 Annual Report

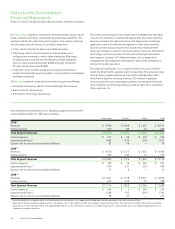

New Accounting Standards and Accounting Changes

FASB Establishes Accounting Standards Codification™

In 2009, the FASB established the Accounting Standards Codification

(“the Codification” or “ASC”) as the official single source of authoritative

U.S. generally accepted accounting principles (“GAAP”). All existing

accounting standards are superseded. All other accounting guidance

not included in the Codification is considered non-authoritative.

The Codification also includes all relevant Securities and Exchange

Commission (“SEC”) guidance organized using the same topical structure

in separate sections within the Codification. The FASB updates the

Codification by issuing Accounting Standard Updates (“ASUs”).

The Codification did not change GAAP, but only the way GAAP is

organized and presented. In order to ease the transition to the

Codification, we are providing the Codification cross-reference

alongside the references to the standards issued and adopted prior

to the adoption of the Codification.

Fair Value Accounting

In 2010, the FASB issued ASU No. 2010-06 which amended Fair Value

Measurements and Disclosures – Overall (ASC Topic 820-10). This

update required a gross presentation of activities within the Level 3 roll-

forward and added a new requirement to disclose transfers in and out

of Level 1 and 2 measurements. The update also clarified the following

existing disclosure requirements in ASC 820-10 regarding: i) the level

of disaggregation of fair value measurements; and ii) the disclosures

regarding inputs and valuation techniques. This update was effective

for our fiscal year beginning January 1, 2010 except for the gross

presentation of the Level 3 roll-forward information, which is effective for

our fiscal year beginning January 1, 2011. The principle impact from this

update is to expand disclosures regarding our fair value measurements.

In 2009, the FASB issued the following updates that provide additional

application guidance and require enhanced disclosures regarding fair

value measurements:

FSP FAS 157-4,

• “Determining Fair Value When the Volume and Level

of Activity for the Asset or Liability Have Significantly Decreased and

Identifying Transactions That Are Not Orderly” (ASC Topic 820-10-65)

FSP FAS 115-2 and FAS 124-2,

• “Recognition and Presentation of

Other-Than-Temporary Impairments” (ASC Topic 320-10-65)

FSP FAS 107-1 and APB 28-1,

• “Interim Disclosures about Fair Value

of Financial Instruments” (ASC Topic 320-10-65)

ASU No. 2009-05,

• “Fair Value Measurements and Disclosures (Topic

820) – Measuring Liabilities at Fair Value”

We adopted these updates in 2009 and the adoptions did not have

a material effect on our financial condition or results of operations.

In 2006, the FASB issued SFAS No. 157, “Fair Value Measurements”

(ASC Topic 820) which defined fair value, established a market-based

framework or hierarchy for measuring fair value and expanded

disclosures about fair value measurements. This guidance is applicable

whenever another accounting pronouncement requires or permits

assets and liabilities to be measured at fair value. It did not expand or

require any new fair value measures; however, the application of this

statement may change current practice. We adopted this guidance for

financial assets and liabilities effective January 1, 2008 and for non-

financial assets and liabilities effective January 1, 2009. The adoption of

this guidance, which primarily affected the valuation of our derivative

contracts, did not have a material effect on our financial condition or

results of operations.

Business Combinations

In 2007, the FASB issued SFAS No. 141 (revised 2007), “Business

Combinations” (ASC Topic 805). This guidance requires the acquiring

entity in a business combination to recognize the full fair value of assets

acquired and liabilities assumed in the transaction (whether a full or

partial acquisition); establishes the acquisition date fair value as the

measurement objective for all assets acquired and liabilities assumed;

requires expensing of most transaction and restructuring costs; and

requires the acquirer to disclose the information needed to evaluate

and understand the nature and financial effect of the business

combination. We adopted this guidance effective January 1, 2009

and have applied it to all business combinations prospectively from

that date. The impact of ASC Topic 805 on our consolidated financial

statements depends upon the nature, terms and size of the acquisitions

we consummate in the future.

Revenue Recognition

In 2009, the FASB issued the following ASUs:

ASU No. 2009-13,

• Revenue Recognition (ASC Topic 605) – Multiple-

Deliverable Revenue Arrangements, a consensus of the FASB Emerging

Issues Task Force. This guidance modified previous requirements by

allowing the use of the “best estimate of selling price” in the absence

of vendor-specific objective evidence (“VSOE”) or verifiable objective

evidence (“VOE”) (now referred to as TPE standing for third-party

evidence) for determining the selling price of a deliverable. A vendor

is now required to use its best estimate of the selling price when

more objective evidence of the selling price cannot be determined. In

addition, the residual method of allocating arrangement consideration

is no longer permitted.

ASU No. 2009-14,

• Software (ASC Topic 985) – Certain Revenue

Arrangements That Include Software Elements, a consensus of

the FASB Emerging Issues Task Force. This guidance modified

the scope of ASC subtopic 985-605 Software-Revenue Recognition

to exclude from its requirements (a) non-software components

of tangible products and (b) software components of tangible

products that are sold, licensed or leased with tangible products

when the software components and non-software components of

the tangible product function together to deliver the tangible

product’s essential functionality.