Xerox 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated

Financial Statements

Dollars in millions, except per-share data and unless otherwise indicated.

76 Xerox 2010 Annual Report

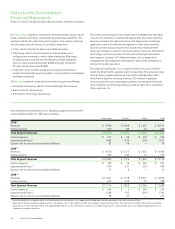

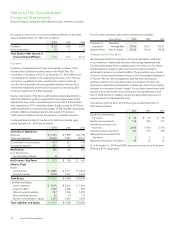

Yen/U.S. Dollar exchange rates used to translate are as follows:

Exchange Basis 2010 2009 2008

Summary of Weighted

Operations Average Rate 87.64 93.51 103.31

Balance Sheet Year-End Rate 81.66 92.46 90.28

Transactions with Fuji Xerox

We receive dividends from Fuji Xerox, which are reflected as a reduction

in our investment. Additionally, we have a Technology Agreement with

Fuji Xerox whereby we receive royalty payments for their use of our Xerox

brand trademark, as well as rights to access their patent portfolio in

exchange for access to our patent portfolio. These payments are included

in Service, outsourcing and rental revenues in the Consolidated Statements

of Income. We also have arrangements with Fuji Xerox whereby we

purchase inventory from and sell inventory to Fuji Xerox. Pricing of the

transactions under these arrangements is based upon terms the Company

believes to be conducted at arm’s length. Our purchase commitments with

Fuji Xerox are in the normal course of business and typically have a lead

time of three months. In addition, we pay Fuji Xerox and they pay us for

unique research and development costs.

Transactions with Fuji Xerox for the three years ended December 31,

2010 were as follows:

2010 2009 2008

Dividends received from

Fuji Xerox $ 36 $ 10 $ 56

Royalty revenue earned 116 106 112

Inventory purchases from

Fuji Xerox 2,098 1,590 2,150

Inventory sales to Fuji Xerox 147 133 162

R&D payments received from

Fuji Xerox 1 3 5

R&D payments paid to Fuji Xerox 30 33 34

As of December 31, 2010 and 2009, net amounts due to Fuji Xerox were

$109 and $114, respectively.

Our equity in net income of our unconsolidated affiliates for the three

years ended December 31, 2010 was as follows:

2010 2009 2008

Fuji Xerox $ 63 $ 30 $ 101

Other investments 15 11 12

Total Equity in Net Income of

Unconsolidated Affiliates $ 78 $ 41 $ 113

Fuji Xerox

Fuji Xerox is headquartered in Tokyo and operates in Japan, China,

Australia, New Zealand and other areas of the Pacific Rim. Our

investment in Fuji Xerox of $1,217 at December 31, 2010 differs from

our implied 25% interest in the underlying net assets, or $1,335, due

primarily to our deferral of gains resulting from sales of assets by

us to Fuji Xerox, partially offset by goodwill related to the Fuji Xerox

investment established at the time we acquired our remaining 20%

of Xerox Limited from The Rank Group plc.

Equity in net income of Fuji Xerox is affected by certain adjustments to

reflect the deferral of profit associated with intercompany sales. These

adjustments may result in recorded equity income that is different than

that implied by our 25% ownership interest. Equity income for 2010 and

2009 includes after-tax restructuring charges of $38 and $46, respectively,

primarily reflecting employee-related costs as part of Fuji Xerox’s

continued cost-reduction actions to improve its competitive position.

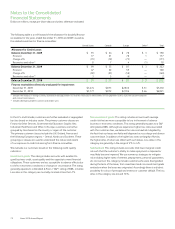

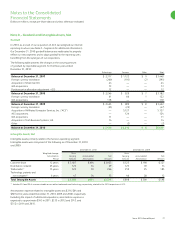

Condensed financial data of Fuji Xerox for the three calendar years

ended December 31, 2010 was as follows:

2010 2009 2008

Summary of Operations

Revenues $ 11,276 $ 9,998 $ 11,190

Costs and expenses 10,659 9,781 10,451

Income before income taxes 617 217 739

Income tax expense 291 67 287

Net Income 326 150 452

Less: Net income –

noncontrolling interests 5 1 7

Net Income – Fuji Xerox $ 321 $ 149 $ 445

Balance Sheet

Assets:

Current assets $ 4,884 $ 4,111 $ 4,734

Long-term assets 5,978 5,457 5,470

Total Assets $ 10,862 $ 9,568 $ 10,204

Liabilities and Equity:

Current liabilities $ 3,534 $ 2,643 $ 3,534

Long-term debt 1,260 1,368 996

Other long-term liabilities 707 1,104 1,095

Noncontrolling interests 22 19 23

Fuji Xerox shareholders’ equity 5,339 4,434 4,556

Total Liabilities and Equity $ 10,862 $ 9,568 $ 10,204